US Stock MarketDetailed Quotes

.IXIC Nasdaq Composite Index

- 17738.162

- +48.503+0.27%

Close May 7 16:00 ET

17820.295High17503.014Low

17706.827Open17689.659Pre Close7.35BVolume20204.58152wk High1634Rise1.79%Amplitude14784.03152wk Low1479Fall17661.655Avg Price153Flatline

The Dow industrials, S&P 500 and Nasdaq Composite all ended slightly higher Wednesday even though the Federal Reserve left interest rates unchanged and hinted at possible "stagflation" risks to the U.S. economy.

The $Dow Jones Industrial Average (.DJI.US)$ gained 284.97 points (0.7%), while the $S&P 500 Index (.SPX.US)$ added 24.37 ticks (0.4%) to 5,631.28. The $Nasdaq Composite Index (.IXIC.US)$ rose the least in...

The $Dow Jones Industrial Average (.DJI.US)$ gained 284.97 points (0.7%), while the $S&P 500 Index (.SPX.US)$ added 24.37 ticks (0.4%) to 5,631.28. The $Nasdaq Composite Index (.IXIC.US)$ rose the least in...

7

2

3

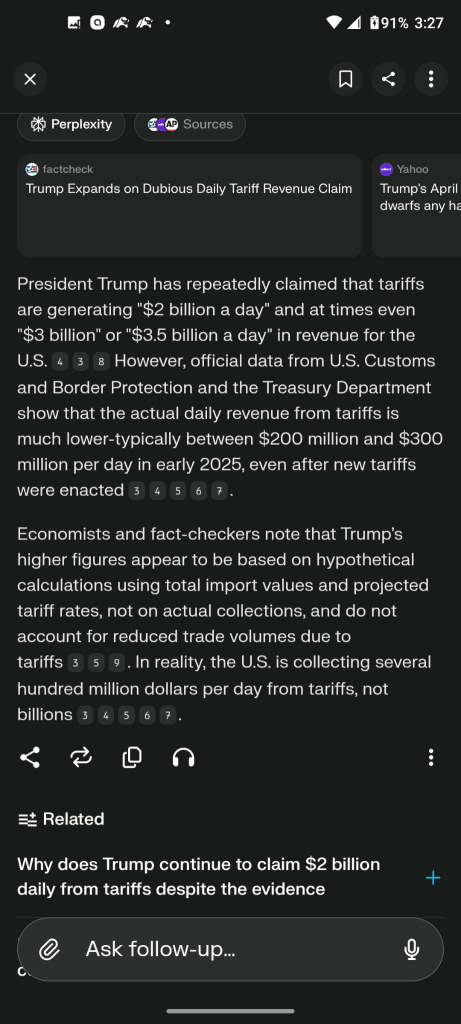

$Nasdaq Composite Index (.IXIC.US)$ This is interesting, I'm listening to an analyst his last name is Gundlach, any saying that the interest on the debt is horrific it's going to be 4 billion dollars a day shortly and will be about 5 billion a day by the end of the year.

and then I remember hearing president Trump say multiple times were collecting billions of dollars a day from the tariffs I think he said $5 billion a day is what I recall him saying as recently as the last cabinet meeting....

and then I remember hearing president Trump say multiple times were collecting billions of dollars a day from the tariffs I think he said $5 billion a day is what I recall him saying as recently as the last cabinet meeting....

1

12

$Nasdaq Composite Index (.IXIC.US)$ Like I said earlier. Giant, nothing burger. Enjoy the sideways grind for at least another three months.

1

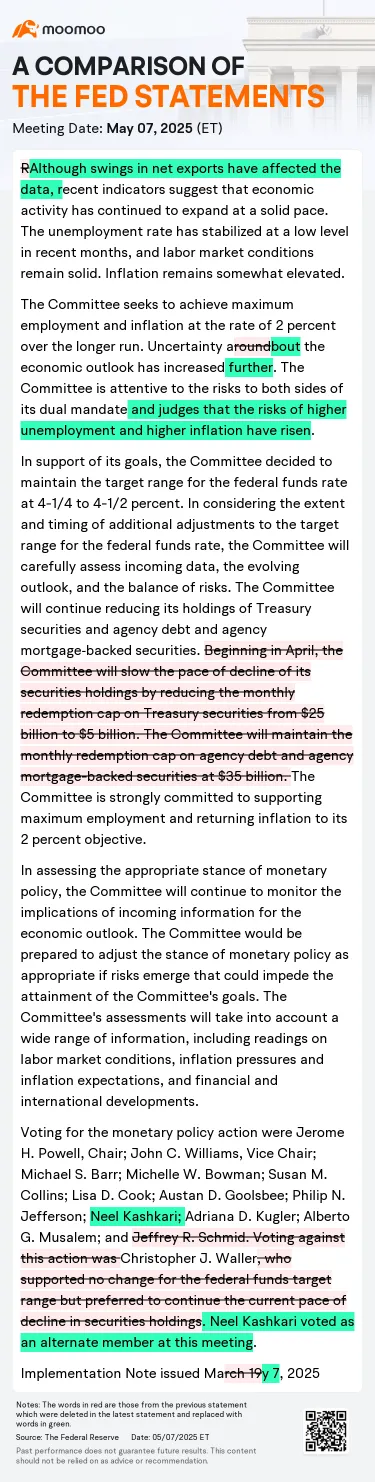

The Federal Open Market Committee kept the target fed funds rate steady at its current level of at of 4.25% to 4.5%, citing rising risks of unemployment and accelerating inflation.

"Uncertainty about the economic outlook has increased further," policymakers said in a statement released at the end of its two-day meeting Wednesday afternoon. "The Committee is attentive to the risks to both sides of its dual mandate a...

"Uncertainty about the economic outlook has increased further," policymakers said in a statement released at the end of its two-day meeting Wednesday afternoon. "The Committee is attentive to the risks to both sides of its dual mandate a...

Expand

Expand 25

7

13

$Nasdaq Composite Index (.IXIC.US)$ for anybody curious what the odds are for a rate cut, it stands at 1.9%

that's like me walking up to the best looking girl when I was in high school and asking her out on a date.. and she said when hell freezes over

so I said I've got a chance..

$Bitcoin (BTC.CC)$ $Advanced Micro Devices (AMD.US)$ $Palantir (PLTR.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

that's like me walking up to the best looking girl when I was in high school and asking her out on a date.. and she said when hell freezes over

so I said I've got a chance..

$Bitcoin (BTC.CC)$ $Advanced Micro Devices (AMD.US)$ $Palantir (PLTR.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

7

$Nasdaq Composite Index (.IXIC.US)$ what happen ,causing waterfall 🌊💦

No comment yet

bullbearnme : If the Federal Reservedoes not cutinterest rates at its current meeting, the U.S. stock market could face several potential impacts:

Negative Effects on the Stock Market:Higher Borrowing Costs for Companies:

Companies will continue to face elevated borrowing costs, which can reduce profit margins.

This may lead to lower corporate earnings, potentially depressing stock prices, especially in capital-intensive sectors like real estate, utilities, and manufacturing.

Slower Economic Growth:

High interest rates can dampen consumer spending and business investment, slowing economic growth.

This typically reduces overall corporate revenues, leading to lower stock valuations.

Market Volatility and Sell-Offs:

Investors who were expecting a rate cut may adjust their portfolios, potentially leading to a market correction.

Growth-oriented and tech stocks, which are particularly sensitive to interest rates, might experience sharper declines.

Stronger U.S. Dollar:

Higher interest rates tend to strengthen the U.S. dollar, which can hurt multinational companies by reducing the value of overseas earnings when converted back to dollars.

This can weigh on the stock prices of companies with significant international exposure.

Positive Effects (Possible but Limited):Support for Financial Sector:

Banks and financial institutions might benefit from higher interest rates as they can charge more for loans.

This can boost the profitability of banks, potentially supporting their stock prices.

Reduced Inflation Pressures:

Steady rates could help keep inflation in check, preserving purchasing power and potentially boosting consumer confidence over the long term.

Long-Term Market Stability:

A cautious Fed approach might reduce the risk of financial instability, supporting long-term market confidence.

Historical Context and Market Sentiment:TheS&P 500andNASDAQhave historically reacted negatively to prolonged periods of high interest rates due to compressed profit margins and reduced risk appetite.

affable Blobfish_403 : What does a strong rally in the closing period mean? Who has such great power?