No Data

00694 BEIJING AIRPORT

- 2.800

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

BEIJING AIRPORT: ANNOUNCEMENTINSIDE INFORMATION

BEIJING AIRPORT (00694.HK) applied to the dealer association to issue medium-term notes in China.

Gelonghui April 29丨BEIJING AIRPORT (00694.HK) announced that the company has formally submitted an application to the Bank Of China Interbank Market Dealers Association for the issuance of the first tranche of medium-term notes with a principal amount of 0.5 billion RMB ("First Medium-Term Notes of 2025"). As of the date of this announcement, it is still uncertain whether this application will be approved and when.

Hong Kong stocks show unusual movement | Aviation/airlines industry generally rises in early trading as falling oil prices ease the cost pressure on airlines, while factors like tariffs strengthen the logic of aviation supply.

In the morning, stocks in the Aviation/airlines Industry rose broadly. As of the time of this report, Air China Limited (00753) is up 3.9%, trading at 4.8 Hong Kong dollars; China Southern Airlines (01055) is up 3.14%, trading at 3.28 Hong Kong dollars; China Eastern Airlines (00670) is up 1.75%, trading at 2.33 Hong Kong dollars; BOC AVIATION (02588) is up 1.03%, trading at 58.8 Hong Kong dollars.

BEIJING AIRPORT: 2024 Annual Report

Hong Kong stocks are moving | Capital Airport (00694) surged over 5% in the morning; the domestic C909 made its maiden flight at Vientiane Wattay International Airport in Laos.

Capital Airport (00694) rose more than 5% in the morning, as of the time of writing, it rose 5.17%, priced at 2.85 Hong Kong dollars, with a transaction volume of 28.2787 million Hong Kong dollars.

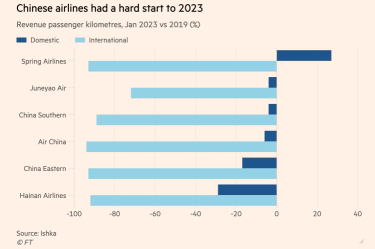

J.P. Morgan: The aviation industry faces significant challenges under the China-U.S. trade war, with Spring Airlines as the top choice.

Under the Sino-US trade war, the aviation/airlines industry faces significant challenges. Due to China imposing a 125% tariff on US imported commodities, the maintenance costs for Airlines and the costs for new aircraft deliveries are expected to rise. Air China Limited (00753) and CHINA SOUTH AIR (01055) are anticipated to be hit the hardest due to the high proportion of Boeing aircraft in their fleets. Furthermore, the USA's 145% tariff on Chinese imported commodities and the removal of the tax exemption threshold is impacting the cargo business of Chinese Airlines, with CATHAY PAC AIR (00293) and China Southern Airlines expecting to bear the brunt.

Comments

$TENCENT (00700.HK)$ │Overweight

$Kweichow Moutai (600519.SH)$ │Overweight

$BABA-W (09988.HK)$ │Overweight

$PETROCHINA (00857.HK)$ │Overweight

$PDD Holdings (PDD.US)$ │Overweight

$AIA (01299.HK)$ │Overweight

$MEITUAN-W (03690.HK)$ │Overweight

$BYD COMPANY (01211.HK)$ │Overweight

$NTES-S (09999.HK)$ │Overweight

$Midea Group Co., Ltd (000333.SZ)$ │Overweight

$HKEX (00388.HK)$ │Overweight

$BIDU-SW (09888.HK)$ │Overweigh...

On January 6, the CAAC claimed that it would increase the proportion of international aviation, cargo aviation, regional aviation, and general aviation in the civil aviation business, accelerate the construction of a new pattern of opening up civil aviation to the outside world and strive for an overall recovery to the pre-epidemic level of 75%.

Just past ...

It will go up to 5.00, We just wait for it🥲🥲

Medium & Long Term - Monopoly

markets. I believe people's will stay away from this stock.

markets. I believe people's will stay away from this stock.