No Data

01966 CHINA SCE GROUP

- 0.123

- +0.001+0.82%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

CHINA SCE GROUP (01966.HK): 7% preferred notes maturing in 2025 delisted.

On April 30, Glonghui reported that CHINA SCE GROUP (01966.HK) announced that, as previously stated, a default event has occurred under the terms of the 7% senior notes due in 2025 ("2025 Notes"), thus trading of the 2025 Notes has been suspended since 9:00 AM on October 5, 2023. As of the date of this announcement, the outstanding principal amount of the 2025 Notes is 0.5 billion USD. As previously stated, the group, along with its advisors, is working hard to seek a comprehensive solution for the interests of all its stakeholders to ensure the sustainable Operation of the group, given the group's tight liquidity.

Brokerage morning meeting highlights: Bullish on investment opportunities in the Commercial Property Sector in 2025.

At today's brokerage morning meeting, Guotai HAITONG SEC proposed to prioritize allocation to leading brokerages with significant comprehensive advantages and stronger cross-border asset allocation capabilities; GF SEC believes that the coal price median may decline in 2025, and leading companies are expected to maintain overall stable profitability; HTSC expressed a Bullish outlook on investment opportunities in the Commercial Property Sector for 2025.

China's Property Market Is Quietly Recovering -- Market Talk

Hong Kong stocks movement | Mainland Real Estate stocks collectively declined, with many stocks falling over 4%. Institutions indicate that Q2 real estate policies tend to support rather than provide strong stimulus.

Mainland Real Estate stocks fell collectively. As of the time of writing, RADIANCE HLDGS (09993) is down 7.22%, priced at 2.7 Hong Kong dollars; GREENTOWN CHINA (03900) is down 5.02%, priced at 9.84 Hong Kong dollars; R&F PROPERTIES (02777) is down 4.63%, priced at 1.03 Hong Kong dollars; RONSHINECHINA (03301) is down 4.4%, priced at 0.239 Hong Kong dollars.

The Finger Research Institute: In the first quarter, the average rent for office buildings in key commercial areas of major cities across the country fell by 0.73% month-on-month.

In the first quarter of 2025, the average rental price of office buildings in major commercial areas of key cities nationwide was 4.58 yuan/square meter/day, a month-on-month decline of 0.73%, with the decrease expanding by 0.12 percentage points compared to the fourth quarter of the previous year, and a year-on-year decline of 2.1%.

Housing Market Stalls as Homeowners Struggle to Sell

Comments

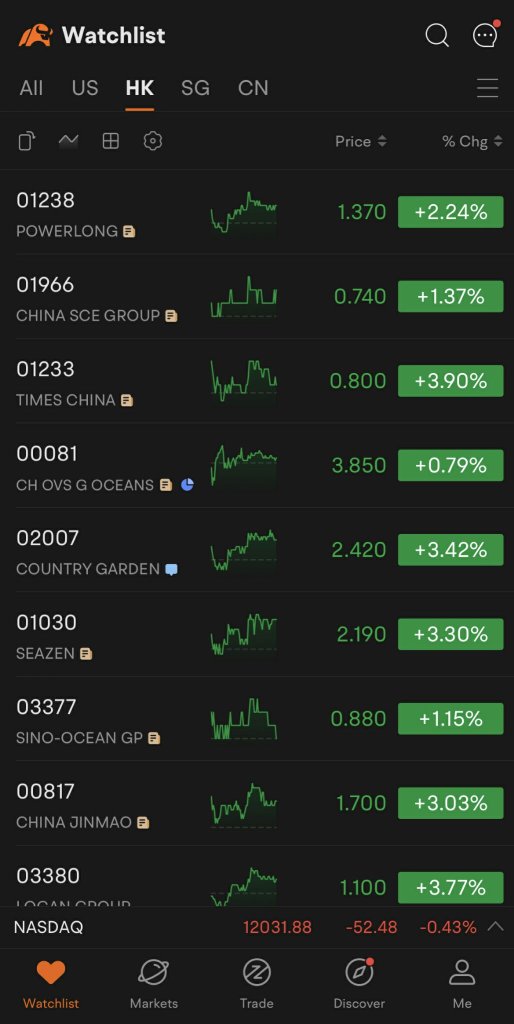

$POWERLONG (01238.HK)$ $CHINA SCE GROUP (01966.HK)$ $TIMES CHINA (01233.HK)$ $CH OVS G OCEANS (00081.HK)$ $COUNTRY GARDEN (02007.HK)$ $SEAZEN (01030.HK)$ $SINO-OCEAN GP (03377.HK)$ $CHINA JINMAO (00817.HK)$ $LOGAN GROUP (03380.HK)$

whqqq : If China’s property market is posting these numbers it underpins strength in the greater economy and boosts consumer confidence.