No Data

AIQ Global X Artificial Intelligence & Technology ETF

- 41.015

- +0.305+0.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Bridgewater's Q1 Hold Positions reflect a "risk aversion principle": heavily buying Alibaba while cutting positions in the S&P and entering the Gold ETF.

In the first quarter of this year, Bridgewater cut its largest Hold Positions, the SPDR S&P 500 ETF, by nearly 60%; Alibaba received full support from Bridgewater to increase its positions, becoming the largest heavily weighted stock; Baidu, PDD Holdings, JD.com, and other representatives of Assets in China were also bought or established positions by Bridgewater.

'Netflix Ad Tier Hits 94 Million Global Monthly Active Users'- Adweek

9 Consumer Discretionary Stocks Whale Activity In Today's Session

10 Information Technology Stocks Whale Activity In Today's Session

Cisco Stock Roars Back On AI Firepower, Saudi Pact — Bullish Breakout Faces Q3 Earnings Test

Decoding IBM's Options Activity: What's the Big Picture?

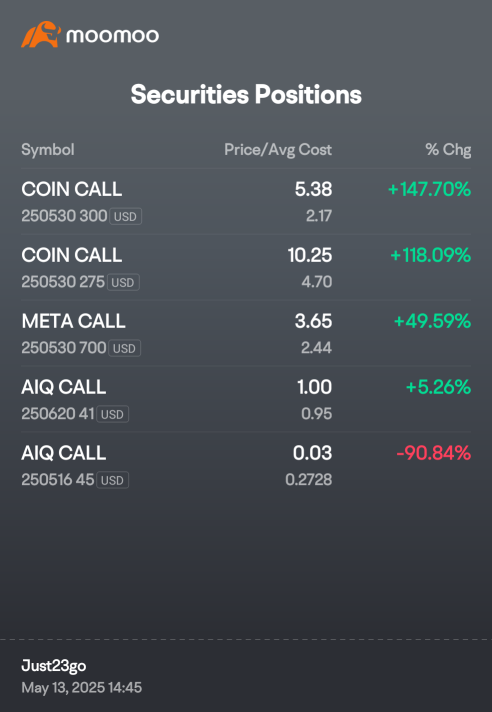

1M1K : Dont show us percentage, show us how much u buy

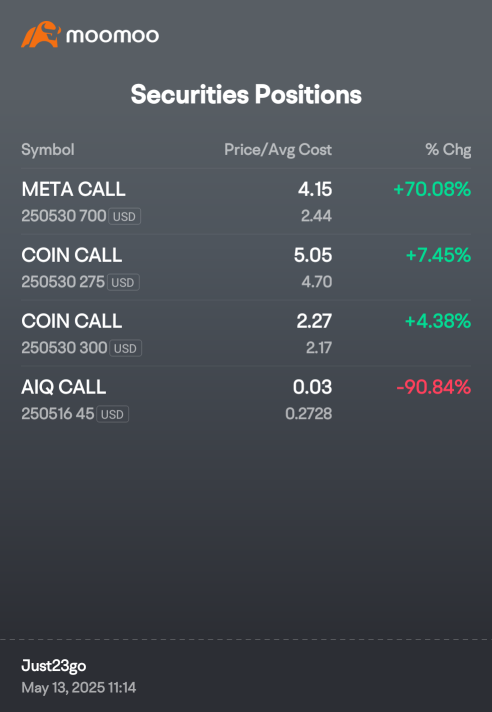

Tliet : I’ve always wondered about timing the market vs. dollar-cost averaging into QQQ. What’s your approach for adding to positions?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

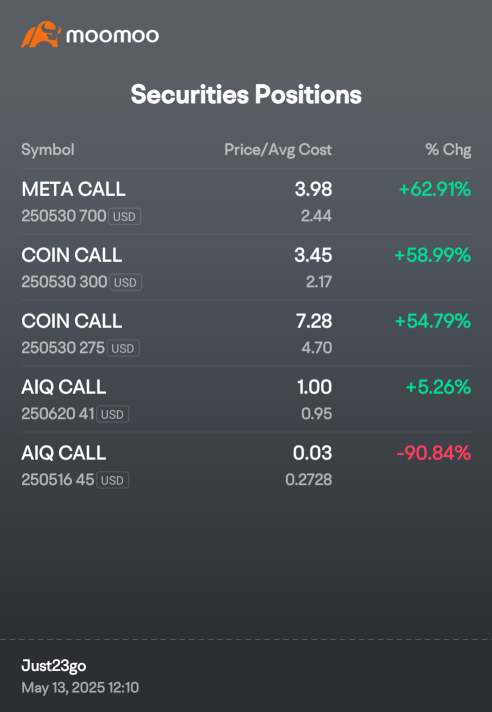

Handiyanan : These gains look great![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) are you planning to roll some into protective puts now, or keep it all directional?

are you planning to roll some into protective puts now, or keep it all directional?

Just23go OP 1M1K : I showed you entry price. Buy what you can afford.

Just23go OP Tliet : I am a true daytrader at heart with stocks and options. I typically buy even number contracts (i.e. between 2 and 100) and sell half midway to expiration or sooner which is why often my post will say (sold too early).

I don't typically add positions to options. I hold very few stocks long term as I believe the market is due for a crash or pullback at some point in the near to mid future.

I invest long term in crypto XRP, XLM, ALGO, XDC, XCN to name a few.

View more comments...