US OptionsDetailed Quotes

AIQ250516C34000

- 2.80

- 0.000.00%

15min DelayClose May 14 16:00 ET

0.00High0.00Low

2.80Open2.80Pre Close0 Volume9 Open Interest34.00Strike Price0.00Turnover107.91%IV-10.22%PremiumMay 16, 2025Expiry Date6.99Intrinsic Value100Multiplier1DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type0.9959Delta0.0041Gamma5.86Leverage Ratio-0.0076Theta0.0015Rho5.83Eff Leverage0.0003Vega

Global X Artificial Intelligence & Technology ETF Stock Discussion

$Global X Artificial Intelligence & Technology ETF (AIQ.US)$

- YouTube

Good analysis on the worry for the Ai Bubble. Solidifies the fundamentals for bull case in $NVIDIA (NVDA.US)$ particularly; as more players join the bandwagon, seems the cake only gets bigger. Salient point is that Ai is assumed to mean generative Ai; however NVIDIA current revenues do include refurbishment of existing infrastructure since accelarated computing costs has ow tipped traditional server x86 servers. Does this mean $Intel (INTC.US)$ will have...

- YouTube

Good analysis on the worry for the Ai Bubble. Solidifies the fundamentals for bull case in $NVIDIA (NVDA.US)$ particularly; as more players join the bandwagon, seems the cake only gets bigger. Salient point is that Ai is assumed to mean generative Ai; however NVIDIA current revenues do include refurbishment of existing infrastructure since accelarated computing costs has ow tipped traditional server x86 servers. Does this mean $Intel (INTC.US)$ will have...

6

@Flowerhill:Everyone know they are not cutting rates, they just want us to be poor

Fed Officials Signaled No Hurry to Cut Rates

Fed Officials Signaled No Hurry to Cut Rates 1

$Global X Artificial Intelligence & Technology ETF (AIQ.US)$ you useless piece of crap ! all AI jumps and you stand still like a duck ! 🤬🤬🤬

Here are two long-term growth investments to consider, along with stocks and ETFs.

Firstly. Electric Vehicles: Australia's EV market just hit 10% penetration. The US, China, and the EU are on track for 60% by 2030.

Denmark, Netherlands, the UK, NZ are banning new fuel cars by 2030. Australia's ACT by 2035.This is driving EV makers sales and earnings.

Secondly consider AI and Chips: Generative AI spending is tipped to grow at 42% annually over the next de...

Firstly. Electric Vehicles: Australia's EV market just hit 10% penetration. The US, China, and the EU are on track for 60% by 2030.

Denmark, Netherlands, the UK, NZ are banning new fuel cars by 2030. Australia's ACT by 2035.This is driving EV makers sales and earnings.

Secondly consider AI and Chips: Generative AI spending is tipped to grow at 42% annually over the next de...

32

3

2

No comment yet

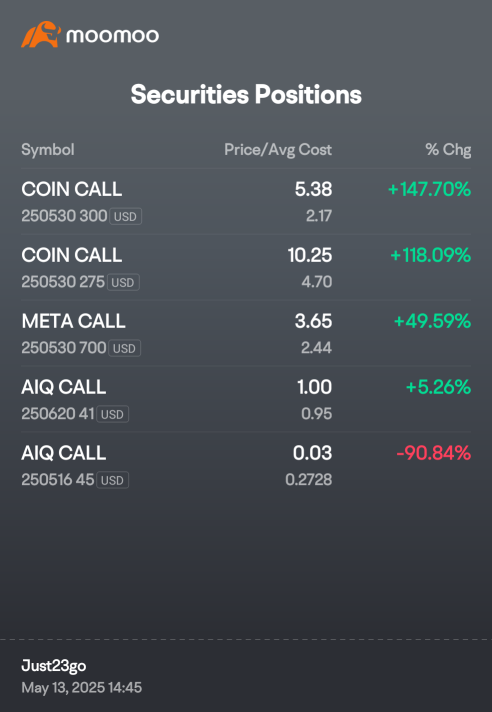

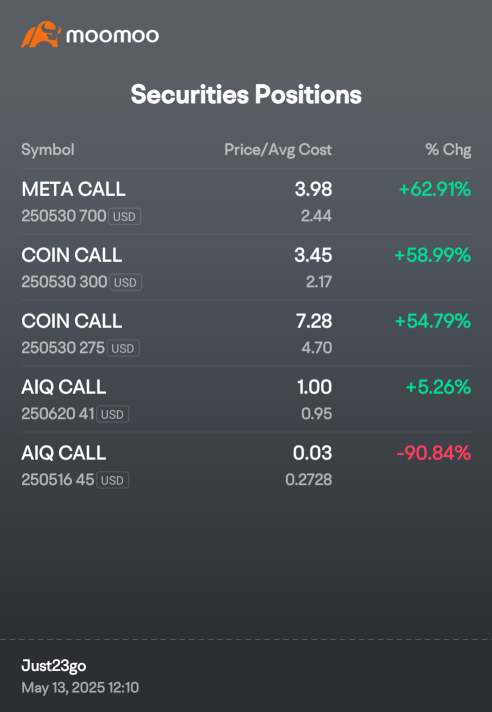

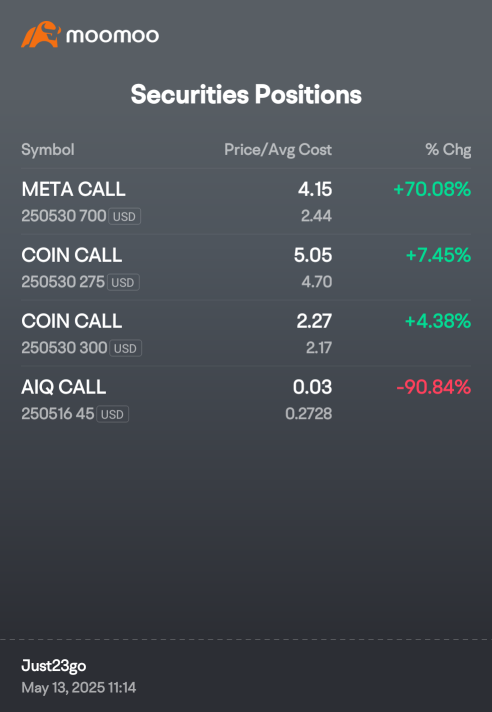

1M1K : Dont show us percentage, show us how much u buy

Tliet : I’ve always wondered about timing the market vs. dollar-cost averaging into QQQ. What’s your approach for adding to positions?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Handiyanan : These gains look great![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) are you planning to roll some into protective puts now, or keep it all directional?

are you planning to roll some into protective puts now, or keep it all directional?

Just23go OP 1M1K : I showed you entry price. Buy what you can afford.

Just23go OP Tliet : I am a true daytrader at heart with stocks and options. I typically buy even number contracts (i.e. between 2 and 100) and sell half midway to expiration or sooner which is why often my post will say (sold too early).

I don't typically add positions to options. I hold very few stocks long term as I believe the market is due for a crash or pullback at some point in the near to mid future.

I invest long term in crypto XRP, XLM, ALGO, XDC, XCN to name a few.

View more comments...