No Data

BAC250509C38000

- 2.91

- -0.23-7.32%

- 5D

- Daily

News

Market Chatter: Fed's Incoming Bank Supervisor Questions Harsh Ratings, May Delay New Scores

'You've Got To Check Emotions At The Door:' Warren Buffett Offers Timeless Investing Wisdom Amid Market Turmoil

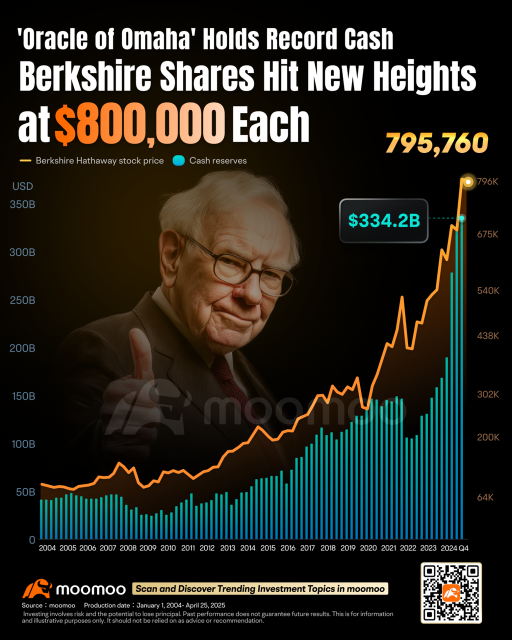

Berkshire Hathaway's cash reserves have increased to a record high, making it difficult to deploy funds amid the turbulent situation.

Berkshire's operating profit has decreased by about 14% year-on-year, and cash reserves have surged to a record $347.7 billion. In the context of uncertainties due to tariffs, the group finds it difficult to effectively deploy funds. In a statement released before the annual meeting in Omaha, Nebraska, led by CEO Warren Buffett, Berkshire reported that its operating profit has dropped to $9.6 billion. The statement mentioned international trade policies and tariffs, indicating that "there is still considerable uncertainty regarding the final outcomes of these events." At the company's annual meeting in Omaha, Buffett spoke more directly about tariffs.

Berkshire investors look forward to Buffett's guidance at the annual meeting: tariffs fluctuations impact the market and economy.

Warren Buffett has remained silent on the issue of tariffs and recent market turmoil, but the 94-year-old investment legend will finally speak at the opening of the Berkshire Hathaway annual Shareholder meeting on Saturday. This weekend, tens of thousands of enthusiastic Shareholders will flood into Omaha, Nebraska, to attend this annual event, dubbed the 'Woodstock for capitalists.' This year's Shareholder meeting marks the 60th year of Buffett leading the company and the second annual meeting since the passing of his long-time partner Charlie Munger, who died at the end of 2023. This year's Berkshire Hathaway Shareholder meeting is considered one of the only events of its kind in Nebraska.

Express News | Berkshire: 69% Of the Aggregate Fair Value of Its Equity Investments Was Concentrated in American Express, Apple, Bank of America, Chevron and Coca-Cola as of March 31

Bank of America Options Spot-On: On May 2nd, 212.04K Contracts Were Traded, With 3.04 Million Open Interest

Comments

In terms of headwinds, Apple and Amazon results don’t seem to impresss investors, which could then drag down the market.

Not to forget, we have a huge employment report coming up shortly.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Grab Holdings (GRAB.US)$ $Sea (SE.US)$ �...

After a month a 1 month vacation, this is my first trade 🥂🧘♂️ $CBOE Volatility S&P 500 Index (.VIX.US)$ waiting to claim under 20 to go full bull 😴✅