- 1504.585

- +11.190+0.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

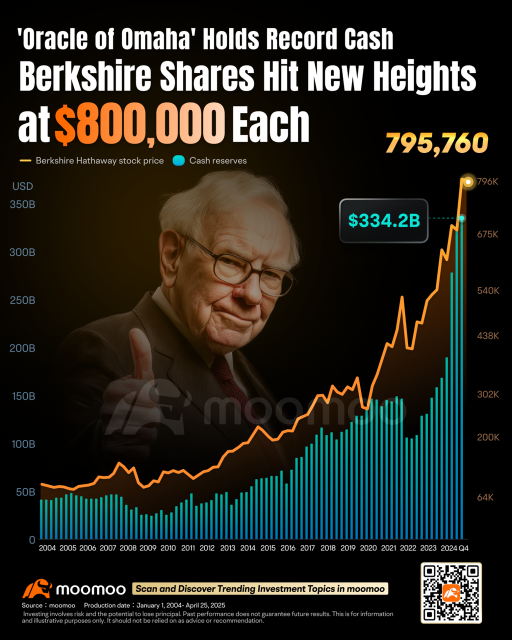

May's Must-See Financial Events: Apple & Nvidia Earnings, Berkshire Meeting, Interest Rate Decision, and More

U.S. stocks closed: the S&P 500 Index has risen for six consecutive days as investors anticipate Trump to adjust the tariff policy.

① Amazon was forced to terminate the plan to display the impact of tariffs on commodity pages; ② China Concept Stocks fluctuated, and the Nasdaq China Golden Dragon Index fell by 0.3%; ③ Meta released an independent AI application aiming to create a personalized Asia Vets assistant; ④ Starbucks reported a Q2 revenue of 8.8 billion dollars, below market expectations.

Invesco RAFI US 1000 ETF Declares $0.15 Dividend

Decoding JPMorgan Chase's Options Activity: What's the Big Picture?

Here's How Much You Would Have Made Owning American International Gr Stock In The Last 5 Years

Ventas Q1 Earnings Preview

Comments

I’d already opened $SPDR S&P 500 ETF (SPY.US)$ to end last week, but closed $JPMorgan (JPM.US)$ to open $Berkshire Hathaway-B (BRK.B.US)$… might lose a little, if Buffett stays in cash too long, buUut I’da lost less had I stayed in cash back when I said, “the SKY is falling!” (just before the sky fell ~;-)

$Berkshire Hathaway-B (BRK.B.US)$

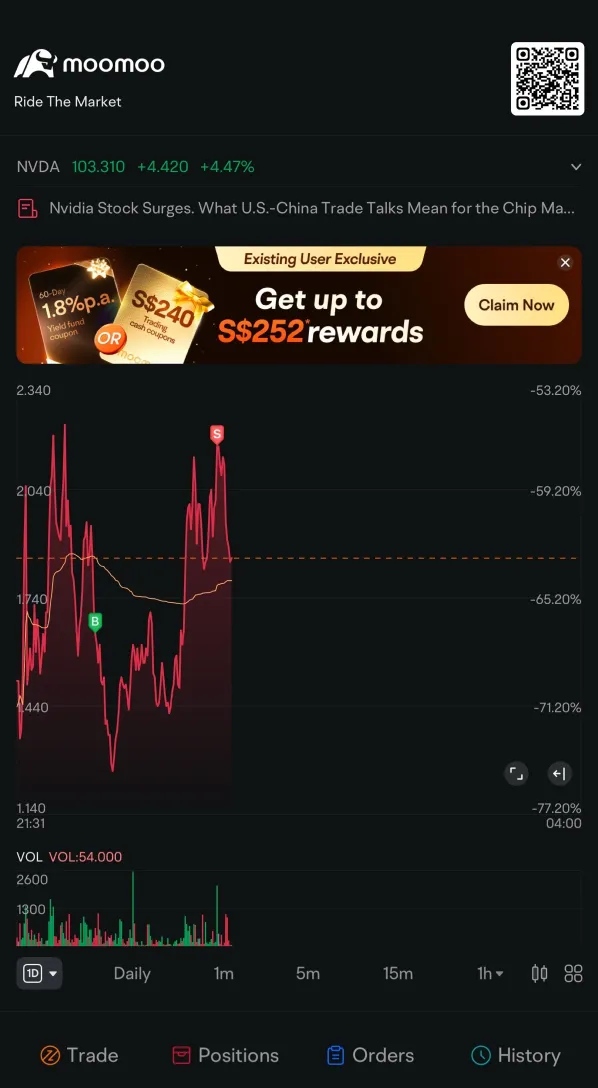

It’s been an eventful week in the markets, with a dramatic shift in sentiment from Monday’s bearish close to a four-day rally starting Tuesday. This change resulted from improving tariff dynamics and slightly better-than-expected earnings reports. As a result, $NASDAQ 100 Index (.NDX.US)$ surged 6.43% for the week, $S&P 500 Index (.SPX.US)$ rose 4.59%, and $Russell 2000 Index (.RUT.US)$ gained 4.09%, reflecting str...