No Data

C250502C95000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Bank of America, Mattel, and 4 Other Stocks Have Priced in Recession. Buy Them. -- Barrons.com

Citibank: HKEX's investment income and operating expenses for the first quarter exceeded expectations, rating "Buy".

Citi released a Research Report stating that the net income of HKEX (00388) for the first quarter of 2025 is 4.1 billion HKD, with a quarterly increase of 8% and a year-on-year increase of 37%, exceeding market expectations by 5%. Total revenue is 6.9 billion HKD, with a quarterly increase of 7% and a year-on-year increase of 32%, exceeding market expectations by 3%, due to strong investment income. Core income is largely in line with expectations, while investment income has increased by 11% quarter-on-quarter but decreased by 1% year-on-year, which is 21% higher than market expectations. Operating expenses amounted to 2 billion HKD, down 4% quarter-on-quarter and up 7% year-on-year, exceeding market expectations by 4%, mainly due to reduced employee costs. The EBITDA profit margin reached 76.

Citigroup: Reaffirms AIA "Buy" rating with a Target Price of HK$99.

Citi has released a Research Report stating that it is impressed with AIA's (01299) consistently stable performance and its resilience in changing industry conditions and macroeconomic environments. This year, the stock price is predicted to be only one times the per-share intrinsic value (P/EV), which makes the valuation reasonable and attractive. They reaffirm a "Buy" rating with a Target Price of HKD 99. Citi pointed out that AIA announced that new business value for the first quarter of 2025 exceeded expectations, achieving growth in business volume and an expansion in profit margins, while also revealing more details about Bonds and the China investment portfolio. Despite the challenges posed by changes in assumptions regarding the China Business, AIA still achieved a 13% new business value in the first quarter of 2025.

Citigroup: Expects Agricultural Bank Of China stock prices to benefit from seeking high-yield investors, rating it as "Buy".

Citi released a Research Report stating that it believes the market has reacted positively to the Agricultural Bank Of China's (01288) first quarter Net income growth of 2.2% year-on-year, based on the bank's non-performing loan coverage ratio being higher than its peers, a focus on domestic Business, and a strong operational foundation in rural and county areas, which may be less affected by the escalation of China-U.S. tariffs, along with the strong incentive measures from the management. The bank currently rates Agricultural Bank Of China as "Buy" with a Target Price of 4.75 Hong Kong dollars. Citi believes that Agricultural Bank Of China has good conditions to sustain profit growth faster than its peers, which will help support its premium valuation compared to other large banks. Since the Postal Savings Bank's A-shares will go ex-dividend on April 30, it may promote a search for ...

Citi: It is expected that CM BANK's premium valuation will be difficult to maintain, with a Target Price of HKD 41.06.

Citi released a Research Report stating that the market reacted negatively to CM BANK's (03968) first quarter Net income, which fell by 2.1% year-on-year, underperforming expectations. It is also believed that this shows limited motivation from management to drive profit growth, as the bank has no capital pressure and can already generate enough internal capital to meet growth demands. The bank currently gives CM BANK's Listed in Hong Kong a "Buy" rating with a Target Price of HKD 41.06. It stated that although CM BANK can still achieve at least positive or flat profit growth for the year, overall final profit growth may still remain sluggish. Coupled with the difficulty in further increasing the dividend payout ratio, it is believed that CM BANK's return on equity may

Citibank: Bank Of Communications' profit growth in the first quarter exceeds that of peers, giving a "Buy" rating.

Citigroup released a research report stating that Bank Of Communications (03328) is expected to have a 1.5% year-on-year growth in profits for the first quarter of the 2025 fiscal year, outperforming its peers, which may help offset some concerns regarding dilution and dividend per share. After considering dilution, Bank Of Communications' H shares still offer a substantial dividend yield of 5%, making it attractive to income-seeking investors. Therefore, the bank anticipates that the market will respond positively to Bank Of Communications' robust performance in the first quarter. Citigroup has set the Target Price for Bank Of Communications at HKD 6.81, giving it a 'Buy' rating.

Comments

Visa Inc. (V), a global leader in digital payments, is set to report its fiscal Q2 2025 earnings on April 29, 2025, after market close, with a conference call at 5:00 PM ET. With a market capitalisation of approximately $625.30 billion as of April 20, 2025, Visa facilitates transactions across over 200 countries, proce...

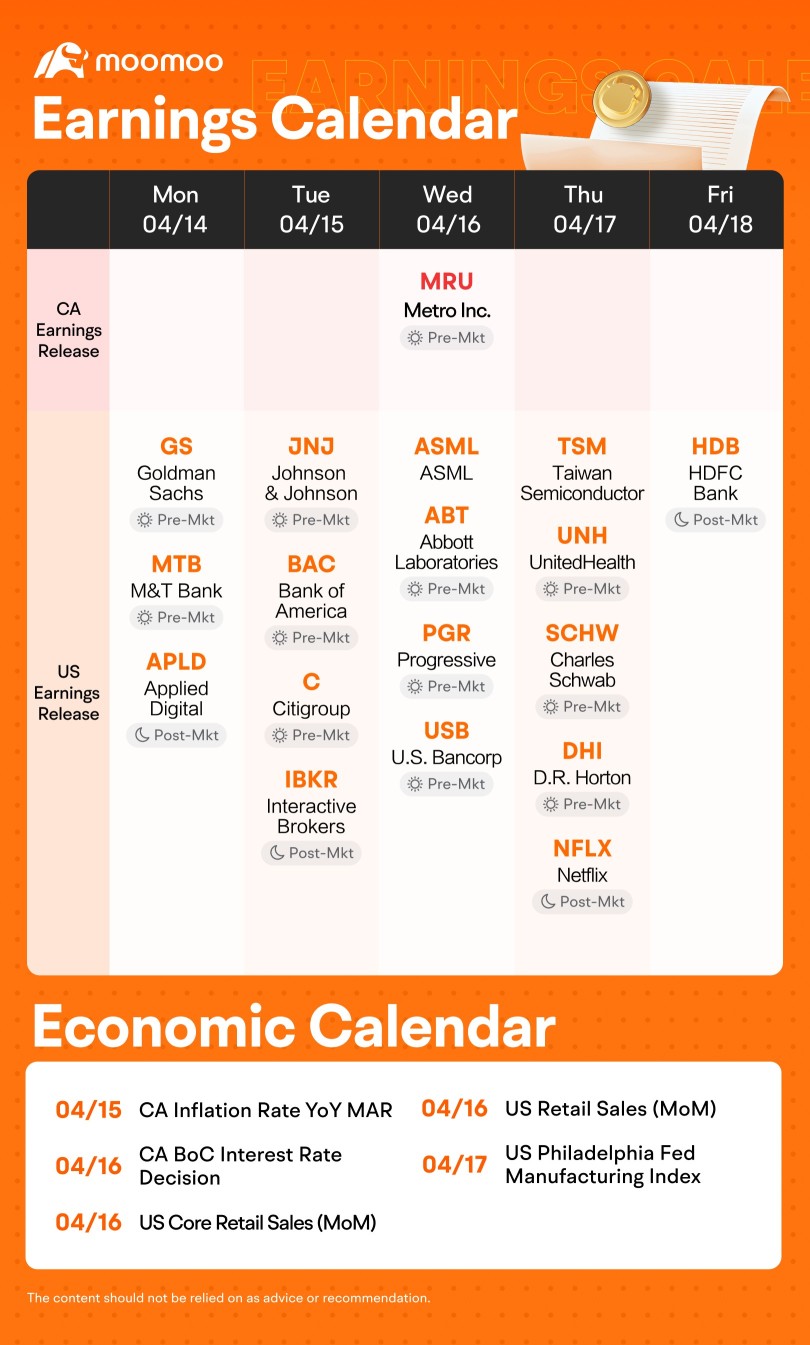

As the earnings season progresses, attention is focused on reports from companies such as $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $ASML Holding (ASML.US)$, $Taiwan Semiconductor (TSM.US)$ and $Netflix (NFLX.US)$. These reports are anticipated to provide valuable insights into how market volatility and tariff uncertainties are influencing their operations.

$Taiwan Semiconductor (TSM.US)$ is schedu...

Deezy_McCheezy : I get the growth story, but isn’t Visa’s valuation already sky-high?

Wendyfbe : I’m also eyeing that 0.74% dividend as a safety net. Thoughts?