No Data

CAF250516C15000

- 0.30

- 0.000.00%

- 5D

- Daily

News

Making Trump happy! Can the wealthy sheikhs of the Middle East really come up with "trillions" so easily?

There is a significant gap between the economic and fiscal capabilities of the Gulf countries and these huge numbers they have committed to; Saudi Arabia's GDP is just slightly above one trillion dollars, and Qatar's GDP is only a little over two hundred billion dollars, while fluctuations in oil prices may further threaten the realization of these commitments.

Trump's slip of the tongue caused a false alarm: how do 160 Boeing passenger planes amount to 200 billion dollars?

① The President of the USA, Trump, visited Qatar on Wednesday and witnessed Boeing signing a massive aircraft procurement agreement with Qatar Airways; ② Trump attempted to flaunt the value of the large Order at the signing ceremony, but got the specific figures wrong; ③ On Wednesday, an economic agreement worth a total of 243.5 billion USD was announced between the USA and Qatar. The leaders of both countries also signed an agreement aimed at facilitating 'at least 1.2 trillion USD in economic exchanges.'

The brief "springtime" for the dollar cannot withstand the long "bearish path"! Hedge funds warn that tariff policies will trigger a wave of dollar selling.

The founder of Exante Data believes that the recent rebound of the dollar is just a fleeting moment, and the long-lasting "dollar bear market" has only just begun, mainly due to a series of chaotic tariff policies aimed at Global trade introduced by the Trump administration to reshape the USA economy and trade.

A major reversal in expectations for the bond market! Options Trading traders are increasing bets on the possibility that the Federal Reserve will not cut interest rates at all this year.

Options traders are aggressively establishing hedge positions to guard against the risk that the Federal Reserve may not ease MMF this year, with one increasingly growing position predicting that the Federal Reserve will not cut interest rates in 2025.

China's Consumer Prices Fall for Third Month; PPI Fall the Most in 6 Months

Evercore ISI: The bear market in the U.S. stock market has ended, and a "marathon-style" bull market is expected under the shadow of tariffs.

The investment bank Evercore ISI pointed out that the latest market rebound marks the end of the bear market in 2025, but unlike in the past, this bull market will not accompany sharp rises, but will instead show a slow and volatile advance.

Comments

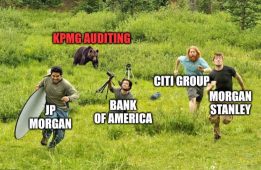

Cramer dubbed the sell-off in “MS” on Wednesday an over reaction considering the weakness in its investment-banking division was broadly expected as both M&A and the IPO market hasn’t been particularly exciting in recent months.

But the Chief Execu...

The recent economic downturn of China and fierce domestic competition environment have sapped the impetuses of Wall Street banks to develop their business prese...