No Data

DBJP Dbx Etf Tr X-Trackers Japan Hedged Equity Fund

- 76.100

- -0.900-1.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

List of conversion stocks (part 3) [List of stocks converted by Parabolic Signal]

○ List of Sell Conversion Stocks Market Code Stock Name Closing Price SAR Main Board <6331> Hiroshi Chemical Machinery 1321 1334 <6358> Sakai Heavy Industry 19942130 <6383> Daihuku 36653978 <6464> Tsubakimoto Nakashima 398417 <6560> LTS 21422204 <6584> Mitsukoshi 608645 <6620> Miyakoshi HD 12481324 <6728> Alback.

Kddi Corporation and others announced a Share Buyback on May 14.

The companies that announced a stock buyback plan on May 14 (Wednesday) are as follows: <9433>Kddi Corporation 0.1 billion 96 million shares (4.5%) 400 billion yen (25/5/15-25/12/23) <6758>Sony Group Corp 0.1 billion shares (1.7%) 250 billion yen (25/5/15-26/5/14) <6971>Kyocera Corporation Sponsored ADR 0.1 billion 36.24 million shares (9.7%) 200 billion yen (25/5/15-26/3/24) <8316>Mitsui Sumitomo 40 million shares (1.0%) 100 billion yen (25/5/

High school students are offered a job with an annual salary of 10 million yen, the hiring situation of U.S. companies.

As the baby boom generation reaches retirement age, companies are tackling the shortage of skilled laborers, and it has been reported that there is an increase in outreach to high school students. Companies seem to believe that such recruitment methods will become even more important in the future. In the USA, Constellation Energy Corp, a major Electrical Utilities company operating Nuclear Power plants, has jobs available as maintenance technicians and equipment Operators for high school graduates, with salaries exceeding six figures, meaning over 0.1 million dollars.

KDDI, for the fiscal year ending March 2025, operating profit increased by 16.3% to 1 trillion 118.6 billion yen, and for the fiscal year ending March 2026, Financial Estimates indicate an increase of 5.3% to 1 trillion 178 billion yen.

KDDI <9433> announced that for the fiscal year ending March 2025, revenue increased by 2.8% year-on-year to 5 trillion 917.9 billion 53 million yen, and operating profit rose by 16.3% to 1 trillion 118.6 billion 74 million yen. For the fiscal year ending March 2026, revenue is projected to increase by 7% year-on-year to 6 trillion 330 billion yen, with operating profit planned to grow by 5.3% to 1 trillion 178 billion yen. The mobile business, driven by high value-added services, continues to perform well, along with contributions from Lawson and the financial services sector. A share buyback of up to 400 billion yen will be conducted.

Nasdaq Gains Over 100 Points; Sony Group Posts Upbeat Earnings

Nissan is cutting jobs globally, Honda is delaying its investment in electric vehicles. Can the "Big Three" Japanese automakers come back to the table?

① Due to the current slowdown in electric vehicle demand, Honda Motor has decided to delay the plan announced on April 25 of last year to establish a comprehensive electric vehicle value chain in Canada by about two years; ② "The company has decided not to release the operating profit expectations for the fiscal year ending March 2026," said Nissan Motor; ③ In the fiercely competitive market in the USA, Japanese automakers are forced to bear high sales incentive costs, while they have not yet fully kept pace in the Chinese market.

Comments

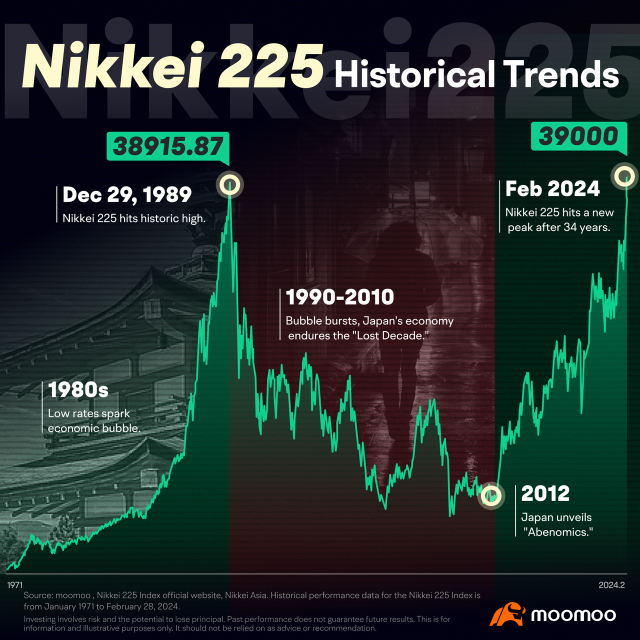

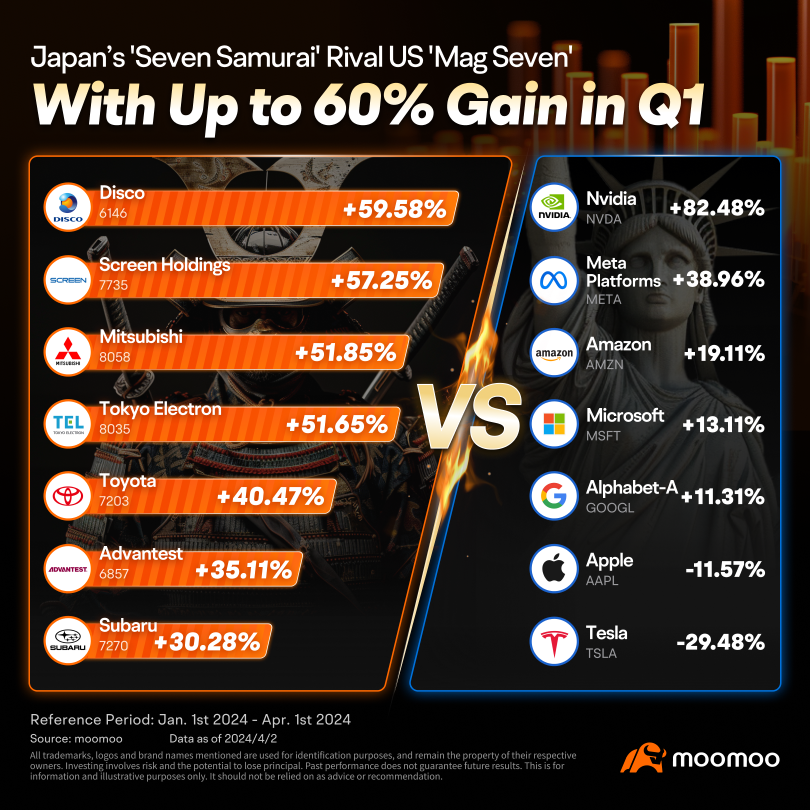

Later, when I had learned more about the Japanese market was from the group mates' chat about "When will Moomoo be listed on the Japanese stock market? The Japanese stock market has been doing well lately."

Invest With Cici : Great sharing!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Good luck with your new adventure!

Good luck with your new adventure! ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) And welcome more mates to join our official learning exchange group! Cici is here waiting for U to explore more possibilities~ Search "Learn Premium" to join!

And welcome more mates to join our official learning exchange group! Cici is here waiting for U to explore more possibilities~ Search "Learn Premium" to join! ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)