US OptionsDetailed Quotes

ESPR250516P2000

- 0.00

- 0.000.00%

15min DelayClose May 1 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest2.00Strike Price0.00Turnover0.00%IV-103.25%PremiumMay 16, 2025Expiry Date1.02Intrinsic Value100Multiplier14DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma0.76Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Esperion Therapeutics Stock Discussion

🚀 2 Biotech Stocks With Explosive Upside Potential: One Targeting a Mega Squeeze, the Other Tackling a $100B Market

While big pharma grabs headlines, two lesser-known biotech companies — Lexaria Bioscience (LEXX) and Esperion Therapeutics (ESPR) — are quietly positioning themselves for dramatic upside. One is addressing the biggest delivery problem in a $100B+ drug market, the other is potentially on the verge of...

While big pharma grabs headlines, two lesser-known biotech companies — Lexaria Bioscience (LEXX) and Esperion Therapeutics (ESPR) — are quietly positioning themselves for dramatic upside. One is addressing the biggest delivery problem in a $100B+ drug market, the other is potentially on the verge of...

11

1

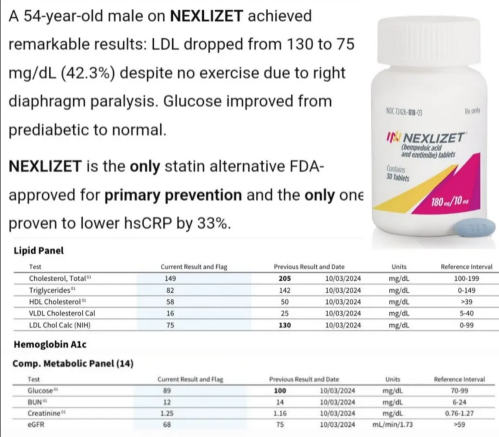

$Esperion Therapeutics (ESPR.US)$Esperion Therapeutics (NASDAQ: ESPR): The Biotech Sleeper Poised for a Mega Short Squeeze

Esperion Therapeutics (NASDAQ: ESPR) is setting up as one of the most asymmetric and explosive trades in biotech. With two FDA-approved therapies, growing revenue, strategic partnerships, and a clear path to profitability, ESPR is firing on all cylinders.

And yet... the stock sti...

Esperion Therapeutics (NASDAQ: ESPR) is setting up as one of the most asymmetric and explosive trades in biotech. With two FDA-approved therapies, growing revenue, strategic partnerships, and a clear path to profitability, ESPR is firing on all cylinders.

And yet... the stock sti...

1

2

1

$Esperion Therapeutics (ESPR.US)$ to the moon?

4

$Esperion Therapeutics (ESPR.US)$

I will Bet Anyone If you BUY This STOCK Now You Will Make 150% Minimum By Years End, with 800% Upside

Please get your Cholesterol level checked every 6 months, it is the #1 cause of DEATH.

Why I’m Buying Esperion Therapeutics $Esperion Therapeutics (ESPR.US)$ in 2025: A Deeply Undervalued Biotech on the Edge of Profitability

Esperion Therapeutics (NASDA...

I will Bet Anyone If you BUY This STOCK Now You Will Make 150% Minimum By Years End, with 800% Upside

Please get your Cholesterol level checked every 6 months, it is the #1 cause of DEATH.

Why I’m Buying Esperion Therapeutics $Esperion Therapeutics (ESPR.US)$ in 2025: A Deeply Undervalued Biotech on the Edge of Profitability

Esperion Therapeutics (NASDA...

9

1

$Esperion Therapeutics (ESPR.US)$ the analyst ratings in the news section is comical. from like 2 to 16 dollars. lol. shouldn't be that much of a discrepancy. analysts are useless

2

2

$Esperion Therapeutics (ESPR.US)$ this js good mews but a way off anythibg tangible yet - we have to how the quarterly briefing they strongly outline nearterm revenue growth for the cholesterol lowerong drug

lifesciencerepo...

lifesciencerepo...

2

1

$Esperion Therapeutics (ESPR.US)$ Follow Linkedin posts by Esperion. $Novartis AG (NVS.US)$ is connected. I expect to hear a Big partnership or acquistion. The stock price is extremely undervalued.

1

3

$Esperion Therapeutics (ESPR.US)$ time to sell

Please get your Cholesterol level checked every 6 months, it is the #1 cause of DEATH.

Why I’m Buying Esperion Therapeutics $Esperion Therapeutics (ESPR.US)$ in 2025: A Deeply Undervalued Biotech on the Edge of Profitability

Esperion Therapeutics (NASDAQ: ESPR) looks like one of the most compelling—and misunderstood—opportunities in biotech. Despite having two FDA-approved drugs, expanding gl...

Why I’m Buying Esperion Therapeutics $Esperion Therapeutics (ESPR.US)$ in 2025: A Deeply Undervalued Biotech on the Edge of Profitability

Esperion Therapeutics (NASDAQ: ESPR) looks like one of the most compelling—and misunderstood—opportunities in biotech. Despite having two FDA-approved drugs, expanding gl...

+3

10

No comment yet

Tonyco : Interesting writeup.

I was long on ESPR for most of last year. Grabbed decent profits, but they ultimately dipped and crashed to pennies. Cut them loose after dilution(iirc).

Their valuation makes no sense to me, simply on sales alone.

I'm just sitting on alerts until they fly.