US OptionsDetailed Quotes

GM250509C46000

- 1.55

- -0.07-4.32%

15min DelayTrading May 9 10:49 ET

1.88High1.44Low

1.66Open1.62Pre Close115 Volume3.70K Open Interest46.00Strike Price20.13KTurnover65.42%IV0.05%PremiumMay 9, 2025Expiry Date1.53Intrinsic Value100Multiplier0DDays to Expiry0.03Extrinsic Value100Contract SizeAmericanOptions Type0.9843Delta0.0551Gamma31.06Leverage Ratio-0.0714Theta0.0002Rho30.58Eff Leverage0.0004Vega

General Motors Stock Discussion

Morning Movers

Gapping Up

$Microsoft (MSFT.US)$ shares jumped nearly 9% after exceeding Wall Street’s earnings and revenue expectations, driven by strong growth in its Azure cloud business and issuing robust guidance for the year.

$Meta Platforms (META.US)$ rose 6% following a first-quarter earnings beat with $6.43 per share on $42.31 billion revenue, surpassing analyst estimates. The company’s increased AI spending also lifted se...

Gapping Up

$Microsoft (MSFT.US)$ shares jumped nearly 9% after exceeding Wall Street’s earnings and revenue expectations, driven by strong growth in its Azure cloud business and issuing robust guidance for the year.

$Meta Platforms (META.US)$ rose 6% following a first-quarter earnings beat with $6.43 per share on $42.31 billion revenue, surpassing analyst estimates. The company’s increased AI spending also lifted se...

29

3

11

$General Motors (GM.US)$

GM slashes profit outlook as $5B tariff shock hits forecast

GM slashes profit outlook as $5B tariff shock hits forecast

Stocks held higher ground in overnight trading despite clear evidence of slowing growth in the world’s two major economies. Weaker US growth and slumping manufacturing in China had little impact as investors appeared to focus on a drop in inflation and the potential for the US Federal Reserve to reduce interest rates.

US GDP contracted in the first quarter of 2025 by 0.3%, well below forecasts of growth at 0.3%. Less than two ...

US GDP contracted in the first quarter of 2025 by 0.3%, well below forecasts of growth at 0.3%. Less than two ...

3

2

US shares rallied in overnight trading as President Trump eased tariffs on automotive makers. The lift in markets brings them close to levels seen just before the “Liberation Day” introduction of tariff, completing a round trip for markets. However strong remarks from President Xi, doubts from corporate America and weakness in copper and oil markets suggest the current rally is fueled by optimism rather than fact.

$Nasdaq Composite Index (.IXIC.US)$

Headlines overnigh...

$Nasdaq Composite Index (.IXIC.US)$

Headlines overnigh...

33

1

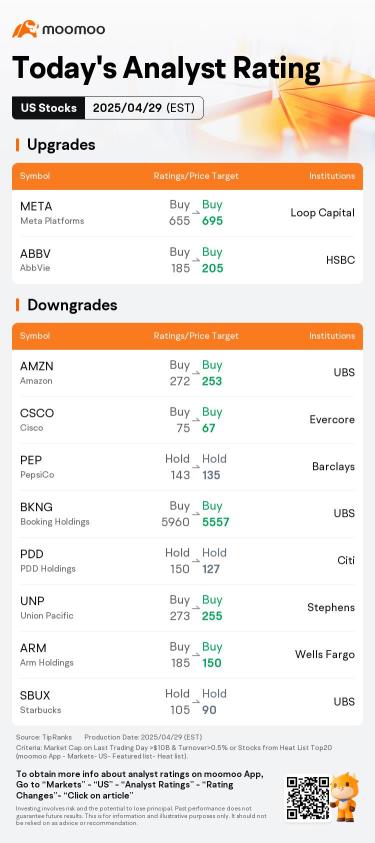

We saw the market experienced volatile trading on Tuesday (29 April) throughout the session. This is due to the initial caution faced by investors due to uncertainties surrounding tariffs, especially after Treasury Secretary Bessent mentioned upcoming discussions with 17 key trade partners, excluding China, which is not currently engaged in tariff talks with the U.S.

Next we saw the April Consumer Confidence Index dropped to 86.0, below e...

Next we saw the April Consumer Confidence Index dropped to 86.0, below e...

![[29 Apr] Despite Volatile Trading Market Closed Positively](https://sgsnsimg.moomoo.com/sns_client_feed/101760671/20250430/2fcac6fc31ba259ea9878e23b74bb86a.png/thumb?area=101&is_public=true)

![[29 Apr] Despite Volatile Trading Market Closed Positively](https://sgsnsimg.moomoo.com/sns_client_feed/101760671/20250430/f46e379eb781db7b6a4d129175e69a5c.png/thumb?area=101&is_public=true)

![[29 Apr] Despite Volatile Trading Market Closed Positively](https://sgsnsimg.moomoo.com/sns_client_feed/101760671/20250430/e1c73ded1a37d32e5bfc262ea16f4a52.png/thumb?area=101&is_public=true)

+1

6

Morning Movers

Gapping Up

$Hims & Hers Health (HIMS.US)$ Hims & Hers surged 34.1% and $Novo-Nordisk A/S (NVO.US)$ increased by 4%. This followed Novo Nordisk's announcement that it will broaden the availability of its weight loss drug Wegovy by offering it through telehealth providers Hims & Hers Health, Ro, and Life MD, now that the drug is no longer facing shortages in the U.S.

$SoFi Technologies (SOFI.US)$ stock rose 5.9% after...

Gapping Up

$Hims & Hers Health (HIMS.US)$ Hims & Hers surged 34.1% and $Novo-Nordisk A/S (NVO.US)$ increased by 4%. This followed Novo Nordisk's announcement that it will broaden the availability of its weight loss drug Wegovy by offering it through telehealth providers Hims & Hers Health, Ro, and Life MD, now that the drug is no longer facing shortages in the U.S.

$SoFi Technologies (SOFI.US)$ stock rose 5.9% after...

20

1

9

Howard Lutnick says ‘deal’ has been reached on auto tariffs

$General Motors (GM.US)$

$Ford Motor (F.US)$

$Tesla (TSLA.US)$

$Lucid Group (LCID.US)$

$Rivian Automotive (RIVN.US)$

$General Motors (GM.US)$

$Ford Motor (F.US)$

$Tesla (TSLA.US)$

$Lucid Group (LCID.US)$

$Rivian Automotive (RIVN.US)$

3

3

Short-term volatility is whipsawing the S&P 500 and global equity markets, and the root cause appears to be the latest wave of trade tariff announcements by President Trump.

While the market is pricing in tariffs as a net negative, at least for now, the reality is that this short-term pain has enough factors playing behind it to turn this situation into long-term gains across the board.

One of the main industries most directly impac...

While the market is pricing in tariffs as a net negative, at least for now, the reality is that this short-term pain has enough factors playing behind it to turn this situation into long-term gains across the board.

One of the main industries most directly impac...

9

3

The S&P 500, Nasdaq Composite and Dow-30 all inched up less than 1% Monday after Apple and other tech giants rose on word that U.S. President Donald Trump had temporarily suspended tariffs on foreign-built tech items like smart phones.

The $S&P 500 Index (.SPX.US)$ led the way higher in percentage terms, gaining 42.61 points (0.8%) to 5,405.97, while the $Dow Jones Industrial Average (.DJI.US)$ rose 312.08 points (0.8%) t...

The $S&P 500 Index (.SPX.US)$ led the way higher in percentage terms, gaining 42.61 points (0.8%) to 5,405.97, while the $Dow Jones Industrial Average (.DJI.US)$ rose 312.08 points (0.8%) t...

12

3

No comment yet

Sir,

Sir,

meowing : good sharing

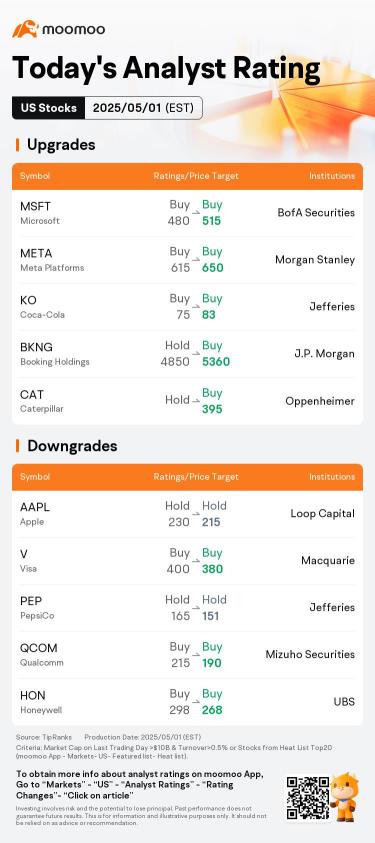

Fortune 5 : i used this rating as a guide. $Microsoft (MSFT.US)$$Meta Platforms (META.US)$ buy n hold

skumaar42 : Great insights!