No Data

IEI iShares 3-7 Year Treasury Bond ETF

- 117.780

- +0.070+0.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Federal Reserve's Barr warns: tariffs raise inflation and slow down the economy, the Federal Reserve may find itself in a dilemma.

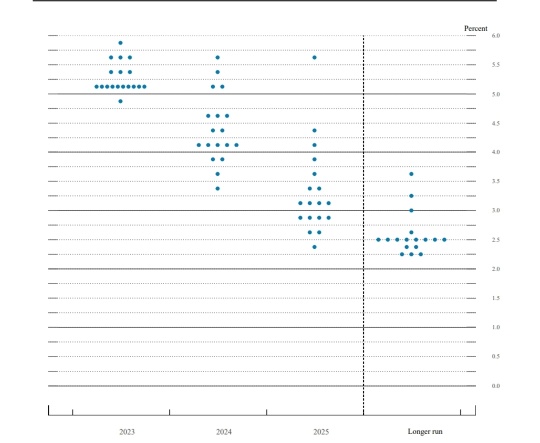

1. Federal Reserve Board member Michael Barr warned that the trade policies of the Trump administration could raise inflation, slow economic growth, and increase unemployment, posing challenges for policymakers; 2. Barr believes that tariffs may disrupt global supply chains, creating sustained upward pressure on inflation and potentially exacerbating supply chain chaos.

The "dollar hegemony" shows cracks in Asia: "de-dollarization" is accelerating and the renminbi is being embraced!

① With last month's unpredictable tariff policies by Trump triggering a wave of asset sell-offs in the USA, a fresh wave of "de-dollarization" is taking root in Asia... ② Multiple signs indicate that the demand for currency derivatives that bypass the dollar is rising among banks and brokers in the Asia region, as trade tensions have added urgency to the shift towards de-dollarization that has been happening for many years.

Following the "new king of bonds," Goldman Sachs also predicts that inflation in the USA will reach 4% this year.

Goldman Sachs predicts that by Christmas, the inflation rate in the USA may reach 4%, while Commodity inflation could surge to 6%-8%. Shortly after the Federal Reserve announced to hold steady on May 7th, and after the press conference by Fed Chair Jerome Powell, Jeffrey Gundlach of DoubleLine Capital also stated, "Given the current situation, the overall CPI increase by the end of this year could reach the '4' threshold."

Yields Jump as Traders Move Into Equities After Trump Says 'Go Out and Buy Stock Now'

Daily Roundup of Key US Economic Data for May 8

SA Analysts Share Opinions on the Latest FOMC Rate Decision

Comments

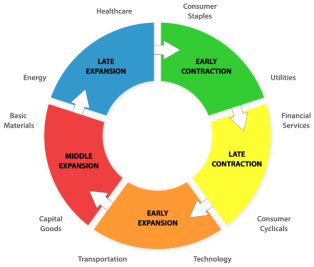

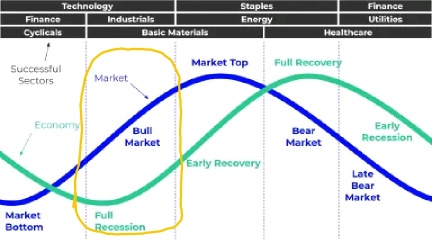

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

Yesterday, the yield of the 10-year US treasury bond rose to 4.14%, the highest since 2008, and the Chinese probability stock companies ...

Invest With Cici : Very good article. How to allocate various assets in a balanced manner and increase the risk tolerance of portfolio positions is a subject that every investor needs to understand!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Moomoo Research OP Invest With Cici :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

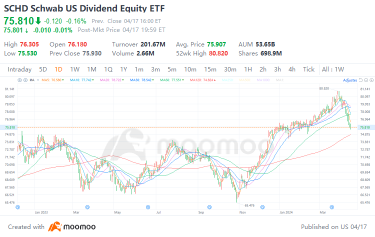

Censorship here : This clams schd has Microsoft within its holding which is incorrect. This facts of this is false

Seven Lady : I think Moo Moo read my mind, as I was asking myself this very same question today, and waa laa, this article popped up to answer it. Thank you for the tips. I most definitely will be changing up my portfolio, as I'm heavily invested in technology companies and American technology companies only. Which is very worrying to me. Even though I'm not sure if this article isn't being a little biased. As it only seems to suggest the only two markets that's great for diversifying one's portfolio is the Hong Kong and American stock market ETF's stocks, gold and bonds or did I misinterpret it??