No Data

IEI250516C101000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Gold fell below $3,150, oil prices dropped over 3%, and the US dollar fell 0.7% against the Japanese yen.

European stocks slightly declined, India’s stock market continued to rise, US oil and Brent crude oil both dropped over 3%, spot Gold fell about 1%, the USD decreased by about 0.3%, and the USD against the Japanese yen fell about 0.7%.

U.S. Treasury Yields Are Stable Ahead of Data -- Market Talk

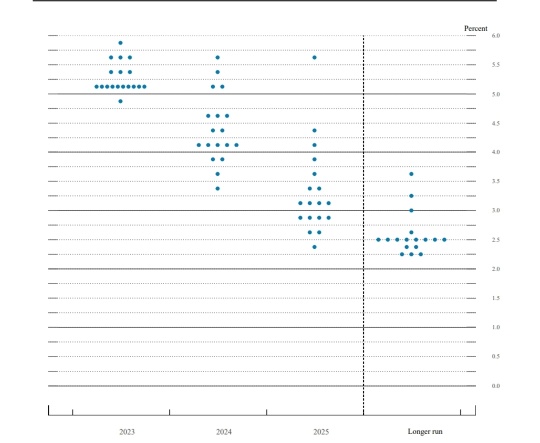

The Fed Wants to Hit Its Inflation Target. Why It Might Not Get To. -- Barrons.com

Peter Schiff Warns Qatar's $200 Billion Boeing Deal Could Spike US Inflation, Interest Rates — Says Treasury Sell-Off May Follow

Express News | JPMorgan: Raises Year-End Forecast for U.S. Treasury Yields

Making Trump happy! Can the wealthy sheikhs of the Middle East really come up with "trillions" so easily?

There is a significant gap between the economic and fiscal capabilities of the Gulf countries and these huge numbers they have committed to; Saudi Arabia's GDP is just slightly above one trillion dollars, and Qatar's GDP is only a little over two hundred billion dollars, while fluctuations in oil prices may further threaten the realization of these commitments.

Comments

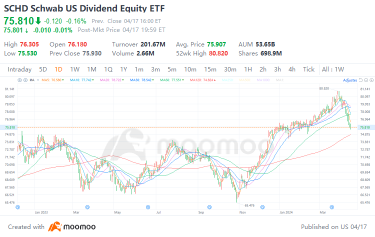

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

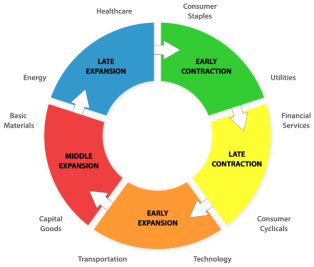

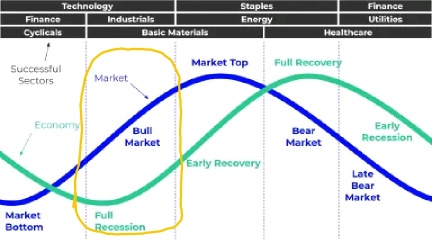

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

Yesterday, the yield of the 10-year US treasury bond rose to 4.14%, the highest since 2008, and the Chinese probability stock companies ...

Invest With Cici : Very good article. How to allocate various assets in a balanced manner and increase the risk tolerance of portfolio positions is a subject that every investor needs to understand!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Moomoo Research OP Invest With Cici :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Censorship here : This clams schd has Microsoft within its holding which is incorrect. This facts of this is false

Seven Lady : I think Moo Moo read my mind, as I was asking myself this very same question today, and waa laa, this article popped up to answer it. Thank you for the tips. I most definitely will be changing up my portfolio, as I'm heavily invested in technology companies and American technology companies only. Which is very worrying to me. Even though I'm not sure if this article isn't being a little biased. As it only seems to suggest the only two markets that's great for diversifying one's portfolio is the Hong Kong and American stock market ETF's stocks, gold and bonds or did I misinterpret it??