No Data

US OptionsDetailed Quotes

IEI250516C123000

- 0.05

- 0.000.00%

15min DelayClose May 13 15:59 ET

0.00High0.00Low

0.05Open0.05Pre Close0 Volume10.01K Open Interest123.00Strike Price0.00Turnover30.54%IV4.99%PremiumMay 16, 2025Expiry Date0.00Intrinsic Value100Multiplier3DDays to Expiry0.05Extrinsic Value100Contract SizeAmericanOptions Type0.0395Delta0.0268Gamma2344.00Leverage Ratio-0.0371Theta0.0004Rho92.51Eff Leverage0.0089Vega

Intraday

- 5D

- Daily

News

Markets Might Face Challenges Interpreting U.S. CPI Data -- Market Talk

Asian Stocks Rally As US-China Trade War Eases, US Dollar Holds Gains

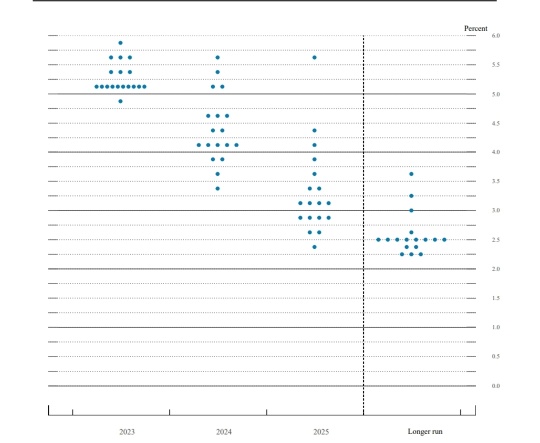

The China-US tariffs have "broken the ice"; Goldman Sachs expects the Federal Reserve's first rate cut to be delayed until December.

Goldman Sachs currently expects the Federal Reserve to make its first rate cut in December, and it has adjusted the peak of the core PCE inflation path to 3.6%.

Stocks Cheered Tariff Relief. Economic Growth Still Hangs in the Balance. -- Barrons.com

Federal Reserve Watch for May 12: Tariffs Effects Could Be 'Significant,' Kugler Says

US Treasury April Budget Slightly Larger Than Expected, Wider Than Year Ago

Comments

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

61

4

35

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

4

4

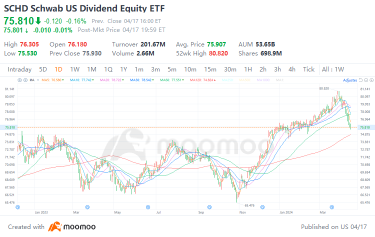

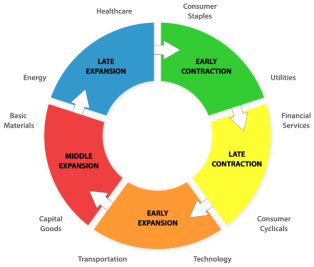

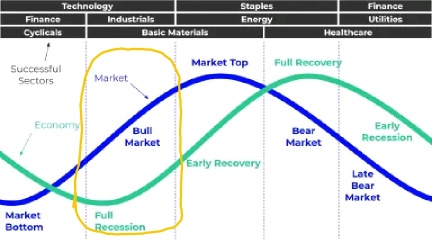

Sector Rotation

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

+2

109

36

54

Fixed Income Investing

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

+1

20

8

8

Today, the technology sector of Hong Kong shares suffered heavy losses, with $TENCENT (00700.HK)$ , $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ , $KUAISHOU-W (01024.HK)$, $XPENG-W (09868.HK)$ and others falling sharply, driving the $Invesco Great Wall CSI HK Equities Technology ETF (513980.SH)$ down 3.51%, with a turnover of more than 160 million yuan.

Yesterday, the yield of the 10-year US treasury bond rose to 4.14%, the highest since 2008, and the Chinese probability stock companies ...

Yesterday, the yield of the 10-year US treasury bond rose to 4.14%, the highest since 2008, and the Chinese probability stock companies ...

Read more

Invest With Cici : Very good article. How to allocate various assets in a balanced manner and increase the risk tolerance of portfolio positions is a subject that every investor needs to understand!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Moomoo Research OP Invest With Cici :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Censorship here : This clams schd has Microsoft within its holding which is incorrect. This facts of this is false

Seven Lady : I think Moo Moo read my mind, as I was asking myself this very same question today, and waa laa, this article popped up to answer it. Thank you for the tips. I most definitely will be changing up my portfolio, as I'm heavily invested in technology companies and American technology companies only. Which is very worrying to me. Even though I'm not sure if this article isn't being a little biased. As it only seems to suggest the only two markets that's great for diversifying one's portfolio is the Hong Kong and American stock market ETF's stocks, gold and bonds or did I misinterpret it??