US OptionsDetailed Quotes

NEM250502P43000

- 0.01

- 0.000.00%

15min DelayClose Apr 30 16:00 ET

0.00High0.00Low

0.01Open0.01Pre Close0 Volume1.23K Open Interest43.00Strike Price0.00Turnover116.91%IV18.39%PremiumMay 2, 2025Expiry Date0.00Intrinsic Value100Multiplier2DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type-0.0068Delta0.0043Gamma5268.00Leverage Ratio-0.0099Theta0.0000Rho-35.74Eff Leverage0.0007Vega

Newmont Stock Discussion

• US markets: The Nasdaq 100 is up 15.9% from its April 7 low. Since then, market fear the VIX has fallen to 25, down from its peak of 60 (which it last hit during COVID).

• Aussie markets: The Australian share market is up 8.9% from its low. Gold producers dim yearly production, implying more upside for gold.

• Stocks to watch: Fortescue, Northern Star and Ramelius, Woodside, Visa, Coca-Cola. And XYZ, Microsoft, Met...

• Aussie markets: The Australian share market is up 8.9% from its low. Gold producers dim yearly production, implying more upside for gold.

• Stocks to watch: Fortescue, Northern Star and Ramelius, Woodside, Visa, Coca-Cola. And XYZ, Microsoft, Met...

From YouTube

35

4

1

The Nasdaq Composite, S&P 500 and Dow-30 all gained better than 1.5% Friday after the White House said it's "optimistic" about reaching a trade deal with China to end a burgeoning trade war between the world's top two economies.

The $Nasdaq Composite Index (.IXIC.US)$ rose 337.14 points (2.1%) to close at 16,724.46, while the $S&P 500 Index (.SPX.US)$ added 95.31 ticks (1.8%) to 5,363.36 and the $Dow Jones Industrial Average (.DJI.US)$ gained 61...

The $Nasdaq Composite Index (.IXIC.US)$ rose 337.14 points (2.1%) to close at 16,724.46, while the $S&P 500 Index (.SPX.US)$ added 95.31 ticks (1.8%) to 5,363.36 and the $Dow Jones Industrial Average (.DJI.US)$ gained 61...

36

14

14

$Barrick Gold (GOLD.US)$, $Newmont (NEM.US)$, $Coeur Mining (CDE.US)$ and other gold- and silver-related stocks rose sharply Friday after gold hit an all-time intraday high and silver added some 4%.

$Gold Futures(JUN5) (GCmain.US)$ gained as much as 2.7% to a $3,263-an-ounce intraday record, while spot $Gold (LIST2110.US)$ hit an all-time high as well.

Comex silver for May delivery likewise added as much as 4.7...

$Gold Futures(JUN5) (GCmain.US)$ gained as much as 2.7% to a $3,263-an-ounce intraday record, while spot $Gold (LIST2110.US)$ hit an all-time high as well.

Comex silver for May delivery likewise added as much as 4.7...

13

3

7

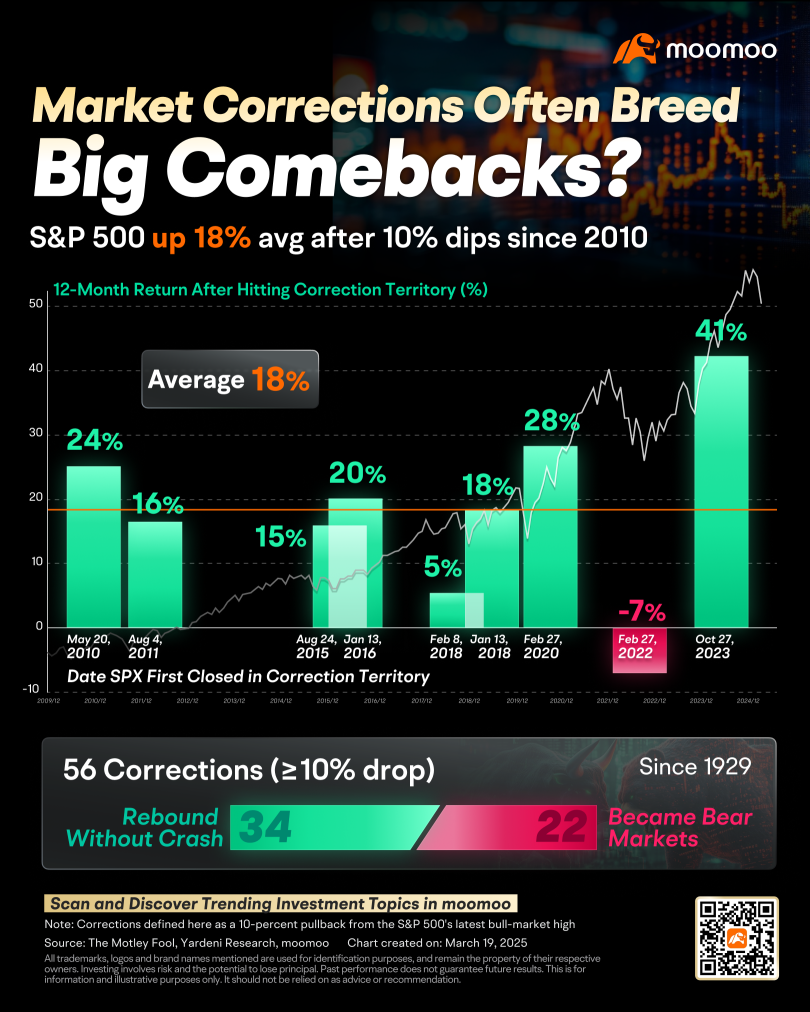

There’s so much going on in markets. Tariffs. Trade wars. There’s lots of fear. But I want to talk about facts. And take a Warren Buffett approach to the Aussie share market and investing. Because we know the market has always recovered from a crash.

So do you buy the dip?

Well, let’s look at the Aussie market over the last year. This year it hit a new record all-time high in Feb. Then fell 10%. But it’s paving a path o...

So do you buy the dip?

Well, let’s look at the Aussie market over the last year. This year it hit a new record all-time high in Feb. Then fell 10%. But it’s paving a path o...

From YouTube

6

Market Status: Multiple Pressures Behind the Correction

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

84

3

142

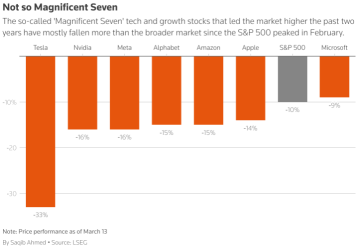

• US markets: In a correction and bracing for a bear market. Nasdaq 100 -13%, S&P 500 -10.1% from last months record high

• Australian markets: In correction, -10.1% from Valentine's Day's record all time high. But gold, silver & copper surge

• Stocks to watch: Nvidia, Tesla, Microsoft, Apple. Bond and Gold ETFs.

Global investors question how low markets can go. Some banks buy the dip in Apple, Microsoft

The Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is down 1...

• Australian markets: In correction, -10.1% from Valentine's Day's record all time high. But gold, silver & copper surge

• Stocks to watch: Nvidia, Tesla, Microsoft, Apple. Bond and Gold ETFs.

Global investors question how low markets can go. Some banks buy the dip in Apple, Microsoft

The Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is down 1...

From YouTube

9

3

1

• US markets: Stocks rally. Nasdaq up 3% overnight – Nvidia up 6.4%, Tesla up 7.6% – while the US dollar falls.

• Australian markets: Commodities to be in focus - with oil up 2% overnight. Gold is up 12% this year, silver up 15%

• Stocks to watch: TSLA, NVDA, AMZN. ASX companies to watch: XYZ, WDS. NEM. Also watch CVX, XOM in oil.

US markets see risk-on rally as US inflation falls. Rally could be maintained if tonight's print shines

It ...

• Australian markets: Commodities to be in focus - with oil up 2% overnight. Gold is up 12% this year, silver up 15%

• Stocks to watch: TSLA, NVDA, AMZN. ASX companies to watch: XYZ, WDS. NEM. Also watch CVX, XOM in oil.

US markets see risk-on rally as US inflation falls. Rally could be maintained if tonight's print shines

It ...

From YouTube

12

1

No comment yet

booyah

booyah

TWIMO (151403908) : Does this herd of bull have the conviction?

-Leprechaun- TWIMO (151403908) : i think today’s bulls might have foot and mouth disease.

yea they’re bulls but we’re going to have to take em out back and shoot em lol.

-Leprechaun- TWIMO (151403908) : too much data likely to hurt the market on the horizon wouldn’t you say?

TWIMO (151403908) -Leprechaun- : Too much data? We’ll need to remove the noisy bits. I can’t wait for Ms. Amir’s reply.

Just to divert a little, I noticed a pattern in Finance/trading experts on Youtube. When the market is up, they tend to recommend stocks, blow own horns, predict and dare viewers to be the next millionaire. However, when the market is down, they advocate being long term investors, quote names of famous investors, steer clear of addressing the stocks that were recommended.