No Data

TLH250516C86000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Gold fell below $3,150, oil prices dropped over 3%, and the US dollar fell 0.7% against the Japanese yen.

European stocks slightly declined, India’s stock market continued to rise, US oil and Brent crude oil both dropped over 3%, spot Gold fell about 1%, the USD decreased by about 0.3%, and the USD against the Japanese yen fell about 0.7%.

U.S. Treasury Yields Are Stable Ahead of Data -- Market Talk

The Fed Wants to Hit Its Inflation Target. Why It Might Not Get To. -- Barrons.com

Peter Schiff Warns Qatar's $200 Billion Boeing Deal Could Spike US Inflation, Interest Rates — Says Treasury Sell-Off May Follow

Making Trump happy! Can the wealthy sheikhs of the Middle East really come up with "trillions" so easily?

There is a significant gap between the economic and fiscal capabilities of the Gulf countries and these huge numbers they have committed to; Saudi Arabia's GDP is just slightly above one trillion dollars, and Qatar's GDP is only a little over two hundred billion dollars, while fluctuations in oil prices may further threaten the realization of these commitments.

US Treasury yields are nearing the critical 5% mark! Market veterans suggest that a "Truss-style collapse" may be needed to force fiscal reforms.

Faced with the continuous fiscal stimulus from the new government, Stephen Jen, head of Eurizon SLJ Capital and a seasoned market veteran, feels deeply worried and has even begun to question whether the USA needs to experience a debt market collapse like that during former UK Prime Minister Liz Truss's term to force the government to change its course.

Comments

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Berkshire Hathaway-B (BRK.B.US)$

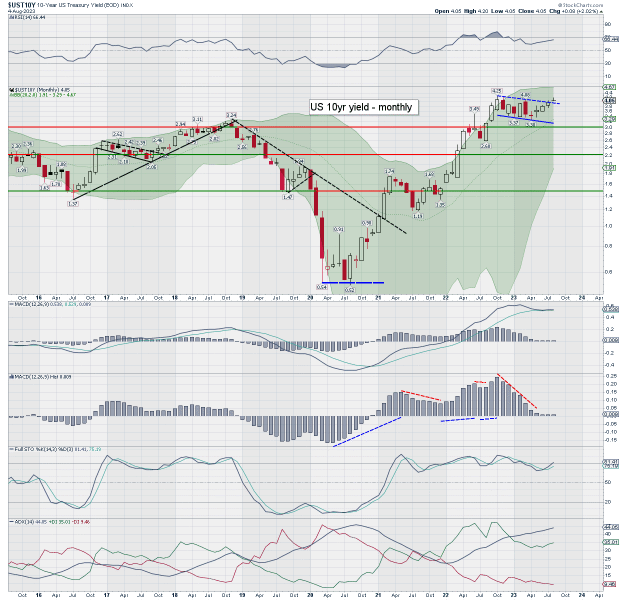

Multi-month structure on the US 10yr yield is a bull flag, and its playing out. Friday... was just some cooling. Soft target... around 4.70%, psy'5.00%, then 7.00%.

I'm starting to wonder if Buffett will live long enough to ever see the Fed cut rates again.

$Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$

$Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$

TradingwithZT OP : DCA more at 102