No Data

TLT250507P102000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Deutsche Bank: The sell-off of USA Assets has been excessive.

Deutsche Bank pointed out that at the beginning of April, the USA market experienced significant volatility, but the panic regarding the dollar, USA Consumer data, and overall confidence in USA Assets may be exaggerated. From a relative valuation perspective, some cyclical USA Consumer stocks may begin to show investment attractiveness. Although policy volatility may persist, the narrative of "selling dollar Assets" may have reached its peak.

The New Taiwan dollar has surged, life insurance has become a major risk, and there is a large-scale mismatch of dollar Assets.

The life insurance industry in Taiwan, China, has long invested a large amount of Assets in US Bonds, and in order to maintain the yield, it only partially hedges its continuously expanding Forex risk exposure, effectively betting its solvency on the New Taiwan Dollar remaining weak against the US Dollar. As the New Taiwan Dollar surges, life insurance companies in Taiwan, China, are rushed to reduce or hedge their dollar exposure.

CBO Director: Still expects the USA debt ceiling "X day" to arrive at the end of summer.

When asked about the potential "X-Date", PHILLIP MM US$D indicated that it is still expected to occur in late summer.

Cantor Fitzgerald Issues Stark Warning on Equities Amid Mounting Economic Risks

Fund Update: Cassaday & Co Wealth Management LLC Just Disclosed New Holdings

Treasury Yields, Dollar Boosted by Stronger-Than-Expected Services PMI -- Market Talk

Comments

Stocks covered in the video (technical analysis) – SPY, Apple, Tesla, Google, Meta, Microsoft, Nvidia + Option trades

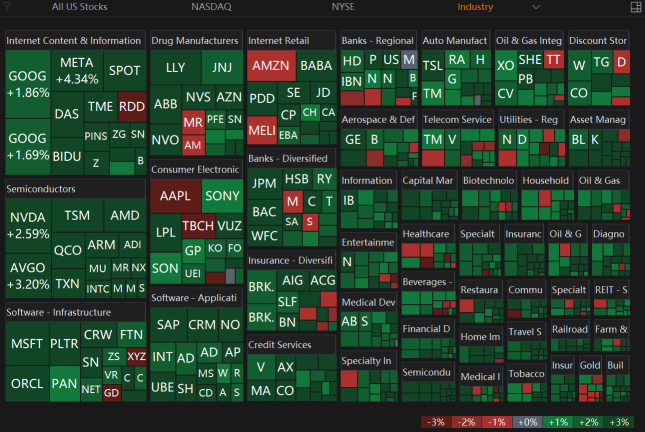

$Trump Media & Technology (DJT.US)$ $Bitcoin (BTC.CC)$ $Salesforce (CRM.US)$ $Arm Holdings (ARM.US)$ $Grab Holdings (GRAB.US)$ $Sea (SE.US)$ $Snap Inc (SNAP.US)$ $Spotify Technology (SPOT.US)$ $CrowdStrike (CRWD.US)$ $Visa (V.US)$ $MasterCard (MA.US)$ $Disney (DIS.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Enphase Energy (ENPH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $Taiwan Semiconductor (TSM.US)$

Ninth Straight Day Of Wins For SPY Streak In 20 Years

This week have given investors a good cl...