No Data

WIRE Global X Copper Miners ETF AUD Inc

- 12.770

- -0.080-0.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

How Do Investors Really Feel About Freeport-McMoRan?

10 Analysts Have This To Say About Freeport-McMoRan

SHARP CORP, ROHM, etc. [List of stock materials from the newspaper]

*SHARP CORP <6753> sold the Kameyama No. 2 plant to Hon Hai, restructuring its performance (Nikkan Kogyo, page 3) - ○ *ENEOS HD <5020> new medium-term plan, M&A and shareholder return of 1 trillion yen, resources invested in decarbonization (Nikkan Kogyo, page 3) - ○ *Renesas <6723> Denso sells shares, automotive Semiconductors procurement reaches certain results (Nikkan Kogyo, page 3) - ○ *Dai-ichi Life HD <8750> additional investment in a UK fund, turn into an equity-method company (Nikkan Kogyo, page 3) - ○ *ORIX <8591> reported net profit of 1 trillion yen for the fiscal year ending March 2035,

On May 12, a Share Buyback announcement was made by Mitsubishi Estate, ETC.

The companies that announced the establishment of their own stock repurchase framework on May 12 (Monday) are as follows: <8591> ORIX 40 million shares (3.5%) 100 billion yen (May 25, 2025 - March 31, 2026) <8802> Mitsubishi Estate 60 million shares (4.8%) 100 billion yen (May 13, 2025 - November 12, 2025) <6417> SANKYO 30 million shares (13.7%) 60 billion yen (May 13, 2025 - March 31, 2026) <9735> SECOM CO 18 million shares (4.3%) 60 billion yen (May 25,

Shares of Metals Stocks Are Trading Higher Amid Overall Market Strength After the US and China Agreed to a Temporary Reduction in Most Tariffs on Each Other's Goods. A Decrease of Trade Tensions Could Reduce Demand Uncertainty for Base Metals.

Recruit HD, operating profit for 25/3 increased by 21.9% to 490.5 billion yen, Financial Estimates for 26/3 expect a 10.1% increase to 540 billion yen.

Recruit HD <6098> announced its financial results for the fiscal year ending March 2025, with revenue increasing by 4.1% year-on-year to 3 trillion 557.4 billion 78 million yen, and operating profit rising by 21.9% to 490.5 billion 42 million yen. The HR Technology business and the Matching & Solutions business saw increased revenue. Operating profit decreased in comparison to the same period last year, where impairment losses were recorded due to office integration, alongside increased revenue and a reduction in other operating expenses. For the fiscal year ending March 2026, revenue is expected to decrease by 1.1% year-on-year to 3 trillion 5200.

Comments

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

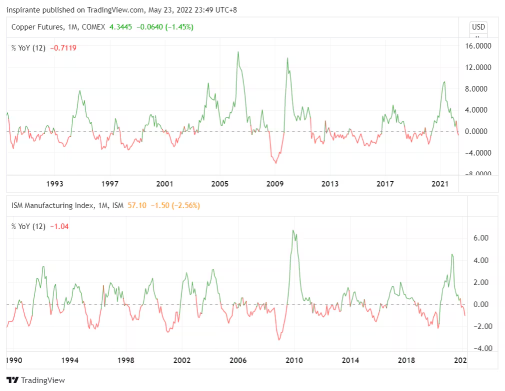

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

What are we seeing? Iron ore prices rose 10% on Monday, seeing the price of the key iron ore ingredient break out of its downtrend to US$112. Australia’s share market $S&P/ASX 200 (.XJO.AU)$ hit a record all-time high on Monday after rising for three consecutive weeks. China's mar...

After the global copper mine supply was impacted at the end of last year, as global manufacturing demand showed signs of recovery, copper mine supply reduction combined with stronger-than-expected demand, and copper prices rose strongly.Recently, the price of copper has been rising steadily and has attracted market attention. The LME copperfuturesprice has reached its highest level in 22 months.

...

151453268 witso : I knew you would come around, spot on we dont want power handouts and negligable tax cuts,we want action and intelligent change not woke glaringly obvious pork barrelling. strength to the beautiful bondi strategist

REYBENDEAD : i love it