What is Yield to Maturity (YTM)

YTM refers to the internal rate of return calculated at the market price if you hold a bond to maturity and the principal and interest of the bond are paid as scheduled. If discounting the bond at YTM, the present value of all its future cash flows (including those of principal and interest) will be equal to the purchase price.

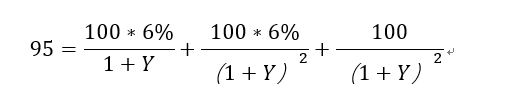

Generally, you can refer to the following formula:

![]()

Where:

Y: yield to maturity

PV: bond market price

M: par value

t: remaining years to maturity

I: coupon rate

If a bond with a par value of 100 has a market price of 95, pays interest at an annual interest rate of 6% and matures in 2 years, then

Its YTM is around 8.78%

Market Insights

Warren Buffett Portfolio Warren Buffett Portfolio

Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry. Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry.

Unlock Now

Discussing

Berkshire 2025 highlights: Stepping aside as CEO, trade and market volatility

$Berkshire Hathaway-A (BRK.A.US)$ held its highly anticipated annual shareholders meeting Saturday. Here are some key takeaways from the eve Show More

Moomoo News Global

Apr 28 18:10

Warren Buffett Stands Tall as U.S. Stocks Tumble: How the 'Oracle' Is Tackling Tariff Impacts

- No more -