No Data

.BKX KBW Nasdaq Bank Index

- 118.410

- +0.949+0.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

U.S. Credit Spreads Tighten as Risk Appetite Improves -- Market Talk

The capital buffers that were opposed in the past have now become a "lifeboat" for the Bank of America.

Two years ago, the large Banks in the USA, which had just experienced market fluctuations, are now facing a turbulent financial environment again. However, this time, thanks to ample capital reserves, almost no one doubts the Industry's ability to withstand risks.

Worried About a Job Loss? Time to Pump up Your Emergency Savings.

Banks Mostly Maintain Guidance Despite Step Up in Uncertainty -- Market Talk

The Federal Reserve is considering significant changes to the stress tests for Banks: proposing to use a two-year data average and extend the compliance buffer period.

The Federal Reserve disclosed on Thursday that it will implement a systematic reform of the annual stress testing mechanism for large Banks.

Westpac Sees Little to No Effect on Consumer Spending to Date From US Tariffs

Comments

Bank Stocks Wobble Amid Tariff Jitters

Bank stocks have been on a tear in recent months, riding hopes of lighter regulation und...

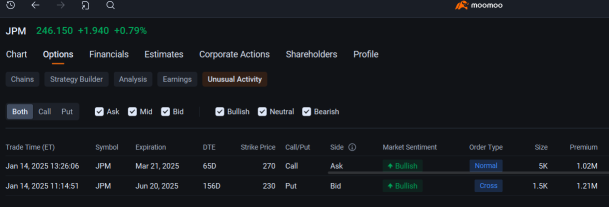

At 11:14:51 a.m. in New York Tuesday, an active seller collected a $1.21 million premium for writing put options that give the holder or holders the right to sell 150,000 JPMorgan shares at $230 by June 20. That bullish trade would be profitable for the sel...

- The Nasdaq Composite gave up 0.39% on Friday to close the week up 0.95%.

- The Nasdaq 100 gave up 0.53% on Friday to close the week up 1.1%.

- The Russell 2000 gained 0.67% on Friday, but still closed the week down 0.14%.

- The S&P Small Cap 600 gained 0.75% on Friday to close the week up 0.22%.

- The S&P Mid Cap 400 gained 0.11% on Friday to close the week up 0.51%.

- The Dow Transports gained 0.64% on Friday, to...

.- The Nasdaq Composite gave up 2.55% on Friday to close the week down 5.77%.

- The Nasdaq 100 gave up 2.69% on Friday to close the week down 5.89%.

- The Russell 2000 gave up 1.91% on Friday to close the week down 5.69%.

- The S&P Small Cap 600 gave up 1.72% on Friday to close the week down 5.26%.

- The S&P Mid Cap 400 gave up 1.39% on Friday to close the week down 4.92%.

- The Dow Transports gave up ...

This widespread sell-off has impacted high growth and technology stocks the most.

On a side note, the rising tension in Middle East is something we should pay special attention to as well.

$Invesco QQQ Trust (QQQ.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Nike (NKE.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Walmart (WMT.US)$ $Home Depot (HD.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Spdr S&P Bank Etf (KBE.US)$ $Lemonade (LMND.US)$ $Block (SQ.US)$ $Riot Platforms (RIOT.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $Peloton Interactive (PTON.US)$

Buy n Die Together❤ :

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ViperStrikes :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)