US Stock MarketDetailed Quotes

.BKX KBW Nasdaq Bank Index

- 118.410

- +0.949+0.81%

Close Apr 29 16:00 ET

118.701High116.438Low

117.181Open117.461Pre Close0Volume140.84852wk High--Rise1.93%Amplitude99.33552wk Low--Fall117.570Avg Price--Flatline

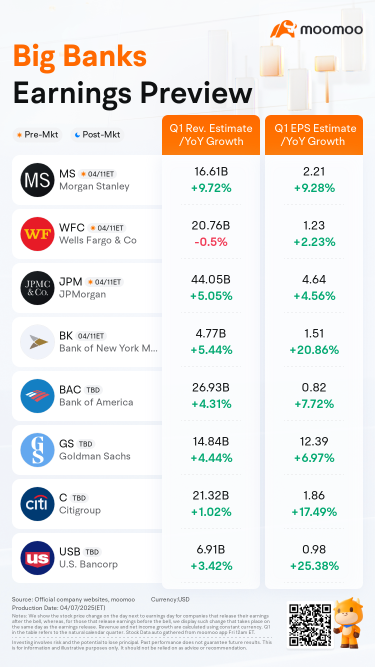

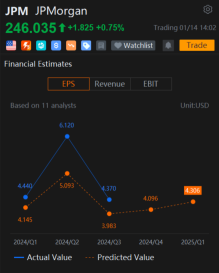

The Q1 2025 earnings season is here, with top U.S. banks ready to share their results. $JPMorgan (JPM.US)$, $Wells Fargo & Co (WFC.US)$, and $Morgan Stanley (MS.US)$ report this Friday, April 11. $Goldman Sachs (GS.US)$ follows on Monday, April 14, with $Bank of America (BAC.US)$ and $Citigroup (C.US)$ wrapping up on Tuesday.

Bank Stocks Wobble Amid Tariff Jitters

Bank stocks have been on a tear in recent months, riding hopes of lighter regulation und...

Bank Stocks Wobble Amid Tariff Jitters

Bank stocks have been on a tear in recent months, riding hopes of lighter regulation und...

+3

33

3

5

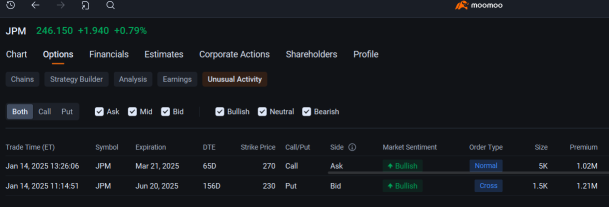

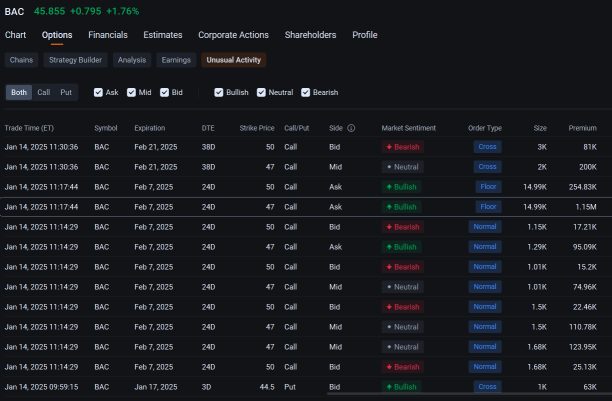

$JPMorgan (JPM.US)$ and $Bank of America (BAC.US)$ saw deep-pocketed investors and large speculators take millions of dollars in options position ahead of earnings.

At 11:14:51 a.m. in New York Tuesday, an active seller collected a $1.21 million premium for writing put options that give the holder or holders the right to sell 150,000 JPMorgan shares at $230 by June 20. That bullish trade would be profitable for the sel...

At 11:14:51 a.m. in New York Tuesday, an active seller collected a $1.21 million premium for writing put options that give the holder or holders the right to sell 150,000 JPMorgan shares at $230 by June 20. That bullish trade would be profitable for the sel...

19

5

23

- The S&P 500 gave up 0.13% on Friday to close the week up 0.62%

- The Nasdaq Composite gave up 0.39% on Friday to close the week up 0.95%.

- The Nasdaq 100 gave up 0.53% on Friday to close the week up 1.1%.

- The Russell 2000 gained 0.67% on Friday, but still closed the week down 0.14%.

- The S&P Small Cap 600 gained 0.75% on Friday to close the week up 0.22%.

- The S&P Mid Cap 400 gained 0.11% on Friday to close the week up 0.51%.

- The Dow Transports gained 0.64% on Friday, to...

- The Nasdaq Composite gave up 0.39% on Friday to close the week up 0.95%.

- The Nasdaq 100 gave up 0.53% on Friday to close the week up 1.1%.

- The Russell 2000 gained 0.67% on Friday, but still closed the week down 0.14%.

- The S&P Small Cap 600 gained 0.75% on Friday to close the week up 0.22%.

- The S&P Mid Cap 400 gained 0.11% on Friday to close the week up 0.51%.

- The Dow Transports gained 0.64% on Friday, to...

4

- The S&P 500 gave up 1.73% on Friday to close the week down 4.25%

.- The Nasdaq Composite gave up 2.55% on Friday to close the week down 5.77%.

- The Nasdaq 100 gave up 2.69% on Friday to close the week down 5.89%.

- The Russell 2000 gave up 1.91% on Friday to close the week down 5.69%.

- The S&P Small Cap 600 gave up 1.72% on Friday to close the week down 5.26%.

- The S&P Mid Cap 400 gave up 1.39% on Friday to close the week down 4.92%.

- The Dow Transports gave up ...

.- The Nasdaq Composite gave up 2.55% on Friday to close the week down 5.77%.

- The Nasdaq 100 gave up 2.69% on Friday to close the week down 5.89%.

- The Russell 2000 gave up 1.91% on Friday to close the week down 5.69%.

- The S&P Small Cap 600 gave up 1.72% on Friday to close the week down 5.26%.

- The S&P Mid Cap 400 gave up 1.39% on Friday to close the week down 4.92%.

- The Dow Transports gave up ...

1

1

Currently, there’s a lot of chatter about a possible global recession. That was why Investors were pulling money out of riskier instrument i.e. stocks, and go for safer bets like bonds and gold.

This widespread sell-off has impacted high growth and technology stocks the most.

On a side note, the rising tension in Middle East is something we should pay special attention to as well.

$Invesco QQQ Trust (QQQ.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Nike (NKE.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Walmart (WMT.US)$ $Home Depot (HD.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Spdr S&P Bank Etf (KBE.US)$ $Lemonade (LMND.US)$ $Block (SQ.US)$ $Riot Platforms (RIOT.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $Peloton Interactive (PTON.US)$

This widespread sell-off has impacted high growth and technology stocks the most.

On a side note, the rising tension in Middle East is something we should pay special attention to as well.

$Invesco QQQ Trust (QQQ.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Nike (NKE.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Walmart (WMT.US)$ $Home Depot (HD.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Spdr S&P Bank Etf (KBE.US)$ $Lemonade (LMND.US)$ $Block (SQ.US)$ $Riot Platforms (RIOT.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $Peloton Interactive (PTON.US)$

From YouTube

6

1

- The S&P 500 gained 1.11% on Friday to close the week down 0.83%.

- The equal-weight S&P 500 gained 1.44% on Friday to close the week up 0.82%.

- The Nasdaq Composite gained 1.03% on Friday to close the week down 2.08%.

- The Nasdaq 100 gained 1.03% on Friday to close the week down 2.56%.

- The Russell 2000 gained 1.67% on Friday to close the week up 3.47%.

- The S&P Small Cap 600 gained 1.81% on Friday to close the week up 3.54%.

- The S&P Mid Cap 400 gain...

- The equal-weight S&P 500 gained 1.44% on Friday to close the week up 0.82%.

- The Nasdaq Composite gained 1.03% on Friday to close the week down 2.08%.

- The Nasdaq 100 gained 1.03% on Friday to close the week down 2.56%.

- The Russell 2000 gained 1.67% on Friday to close the week up 3.47%.

- The S&P Small Cap 600 gained 1.81% on Friday to close the week up 3.54%.

- The S&P Mid Cap 400 gain...

5

S&P500 and Nasdaq had a nice little 1% pop on Monday

Seems like the market was building on Friday’s weaker-than-expected jobs reports - much fewer jobs were added in April + a small rise in unemployment. This has given investors some hope and confidence that Fed may cut rates soon before the economy breaks down.

By the way, there are quite a number of Fed officials speaking this week (no less than 5)

$Bitcoin (BTC.CC)$ $Lockheed Martin (LMT.US)$ $iShares Bitcoin Trust (IBIT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Workday (WDAY.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Morgan Stanley (MS.US)$ $The Trade Desk (TTD.US)$ $Lemonade (LMND.US)$ $Upstart (UPST.US)$ $DraftKings (DKNG.US)$ $Corsair Gaming (CRSR.US)$ ��������...

Seems like the market was building on Friday’s weaker-than-expected jobs reports - much fewer jobs were added in April + a small rise in unemployment. This has given investors some hope and confidence that Fed may cut rates soon before the economy breaks down.

By the way, there are quite a number of Fed officials speaking this week (no less than 5)

$Bitcoin (BTC.CC)$ $Lockheed Martin (LMT.US)$ $iShares Bitcoin Trust (IBIT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Workday (WDAY.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Morgan Stanley (MS.US)$ $The Trade Desk (TTD.US)$ $Lemonade (LMND.US)$ $Upstart (UPST.US)$ $DraftKings (DKNG.US)$ $Corsair Gaming (CRSR.US)$ ��������...

From YouTube

3

Major indexes fell a little as the market await the new inflation data. The topic of when is the first rate cut will be back again.

A softer inflation figure could likely spark another rally as the odds of a rate cut coming soon would be higher. In case you’re not aware, generallt speaking, lower interest rate will benefit companies aa the cost of borrowing will be cheaper.

$Advanced Micro Devices (AMD.US)$ $Apple (AAPL.US)$ $Taiwan Semiconductor (TSM.US)$ $Morgan Stanley (MS.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Workday (WDAY.US)$ $SPDR Gold ETF (GLD.US)$ $Pfizer (PFE.US)$ ��������...

A softer inflation figure could likely spark another rally as the odds of a rate cut coming soon would be higher. In case you’re not aware, generallt speaking, lower interest rate will benefit companies aa the cost of borrowing will be cheaper.

$Advanced Micro Devices (AMD.US)$ $Apple (AAPL.US)$ $Taiwan Semiconductor (TSM.US)$ $Morgan Stanley (MS.US)$ $KBW Nasdaq Bank Index (.BKX.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Workday (WDAY.US)$ $SPDR Gold ETF (GLD.US)$ $Pfizer (PFE.US)$ ��������...

6

2

The Mag 7 has driven the stock market to all time high, giving investors stunning returns. But such phenomenon is a double edged sword.

They say, water can float a boat as it can capsize it (水能载舟,亦能覆舟), therefore the same stocks can also be the cause that drive the market down.

As lots of optimism have been priced in, so it’s no longer about meeting earnings expectations for these megacap companies, it’s about offering solid guidance and company outlook.

$Netflix (NFLX.US)$ $Dow Jones Industrial Average (.DJI.US)$ ��������...

They say, water can float a boat as it can capsize it (水能载舟,亦能覆舟), therefore the same stocks can also be the cause that drive the market down.

As lots of optimism have been priced in, so it’s no longer about meeting earnings expectations for these megacap companies, it’s about offering solid guidance and company outlook.

$Netflix (NFLX.US)$ $Dow Jones Industrial Average (.DJI.US)$ ��������...

14

2

No comment yet

Buy n Die Together❤ :

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ViperStrikes :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)