No Data

002142 Bank Of Ningbo

- 26.32

- +0.84+3.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

GF SEC: The continuous improvement in the cost of liabilities provides support, and it is expected that the decline in Banks' interest margins will gradually slow down by 2025.

Looking ahead to the full year of 2025, it is expected that Banks' interest margin decline will stabilize quarter by quarter, overall better than in 2024.

The Bank Of Ningbo's dual increase in deposits and loans drives high growth, highlighting resilience in serving the real economy.

On the evening of April 28, Bank Of Ningbo officially released its first quarterly report for 2025. The Earnings Reports show that the company achieved a net income of 7.417 billion yuan attributable to shareholders of the parent company in the first quarter, an increase of 5.76% year-on-year; achieved revenue of 18.495 billion yuan, an increase of 5.63% year-on-year; the company's non-performing loan ratio is 0.76%, and asset quality continues to maintain a relatively high level in the industry. After delivering an excellent report in 2024, Bank Of Ningbo performed outstandingly again in this year's first quarter 'monthly exam'. Among the listed commercial banks that have published their 2024 annual reports, there is a clear difference showing that 'large state-owned banks are stable while small and medium-sized banks are growing quickly.'

Bank of Ningbo: Report for the first quarter of 2025

Express News | Bank of Ningbo Says Q1 Net Profit up 5.8% Y/Y

Public Companies Among Bank of Ningbo Co., Ltd.'s (SZSE:002142) Largest Shareholders, Saw Gain in Holdings Value After Stock Jumped 5.0% Last Week

Research Reports Gold Mining | Zheshang: Bank Of Ningbo's dividend payout ratio increases, maintaining a 'Buy' rating.

The Zheshang Research Report indicates that Bank Of Ningbo (002142.SZ) has a revenue growth of +8.2% year-on-year and a parent Net income growth of +6.2% for 2024, compared to +0.7pc and -0.8pc in the first three quarters of 2024, respectively. The revenue growth rate has improved on a quarter-on-quarter basis, mainly benefiting from the recovery of the interest margin and the improvement of drag factors. Bank Of Ningbo plans a dividend payout ratio of 22.8% for 2024, significantly increasing by 6.8pc compared to 2023, with an expected dividend yield of 3.85% corresponding to 2024 by April 9, 2025, fully demonstrating Bank Of Ningbo's sincerity in returning to Shareholders. Looking ahead, Bank Of Ningbo's revenue is expected to maintain a small...

Comments

$Luxshare Precision Industry (002475.SZ)$

$Hangzhou Hikvision Digital Technology (002415.SZ)$

$Muyuan Foods (002714.SZ)$

$NAURA Technology Group (002371.SZ)$

$CGN Power Co.,Ltd. (003816.SZ)$

$S.F. Holding (002352.SZ)$

$Bank Of Ningbo (002142.SZ)$

$Jiangsu Yanghe Distillery (002304.SZ)$

$Guosen (002736.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

$Focus Media Information Technology (002027.SZ)$

$Rongsheng Petro Chemical (002493.SZ)$

$Zhejiang Sanhua Intelligent Controls (002050.SZ)$

���������...

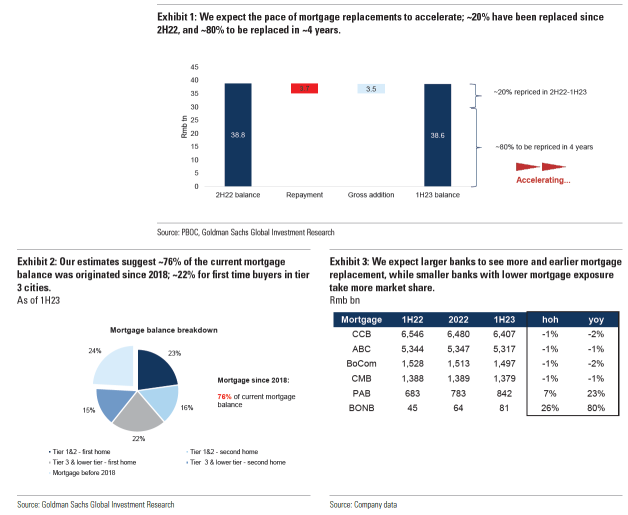

We expect 1) the pace of mortgage replacements to accelerate on a one-off rate cut on existing mortgages. Previously, we estimated ~4 more years to complete the mortgage replacement, assuming ~10% replacement completes in a half year and that the replacement cycle started in 2H22, and that ~20% of the mortgage book had been remortgaged by end-1H23.(...